- Report Summary

- Table of Content

- Methodology

- Request for ESG Consultation

Report Overview

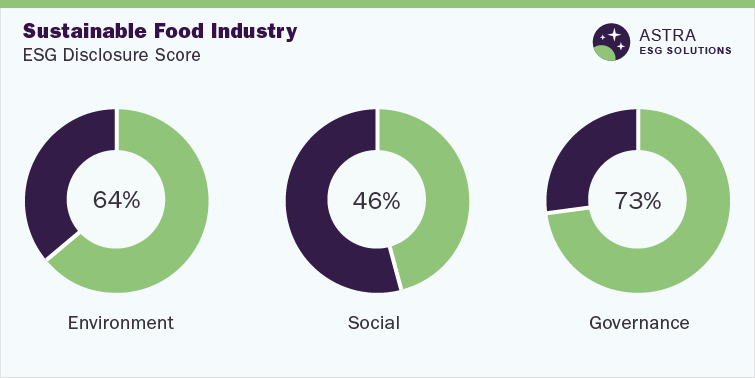

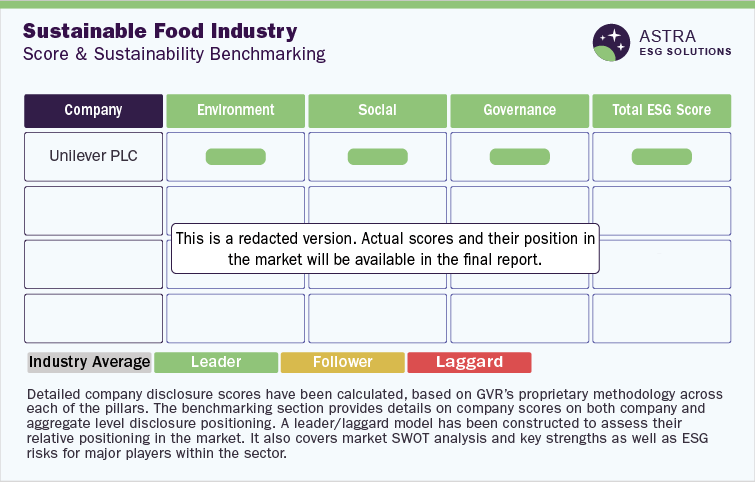

The average ESG disclosure score for the sustainable food industry stands between 60% and 70%. This conclusion is based on the analysis of more than 60 Environment, Social, & Corporate Governance (ESG) parameters within our ESG scoring framework. Alongside Unilever PLC, Nestle S.A. and seven other market leaders were part of our research. This research identified that only three companies, including Unilever PLC, Nestle S.A., and Danone S.A., scored above the average industry score, while the two other companies are identified as laggards, needing to improve their ESG transparency & reporting, as they scored well below 60%.

Our research found that the majority of the ESG disclosures have been made around the governance metric in the sustainable food industry, with Unilever PLC being a leader in this sector compared to other companies, such as Nestle S.A. (from an overall ESG disclosure point of view). Players in this industry have a large scope of improvement in improving their social disclosure as the average social disclosure score falls well below 50%.

Environmental Insights

Sustainable food refers to food that is produced in a way that does not deplete natural resources or harm the environment. This includes food that is produced through modest usage of water and minimum to no use of inorganic supplements to grow crops. It also emphasizes foods that emit little or reduced Greenhouse Gas (GHG) emissions.

Sustainable food is produced in a socially and economically responsible manner related to the supply chain, providing fair wages to workers, and supporting local communities. One of the key underlying factors for the production of sustainable food is sustainable agriculture, which aims at creating a food system that is healthy and sustainable for both the people and the planet. The core concept of sustainable food involves four pillars, which are developing more sustainable food distribution practices and systems, developing sustainable agricultural practices, reducing food wastage, and encouraging sustainable and health-conscious diets.

According to our research in the sustainable food industry, most of the companies have made disclosures about emissions, energy consumption, waste management, and water management programs. More than 80% of the profiled companies have reported direct and indirect emissions, defined long-term and short-term targets for achieving net-zero emissions goals and set waste reduction targets.

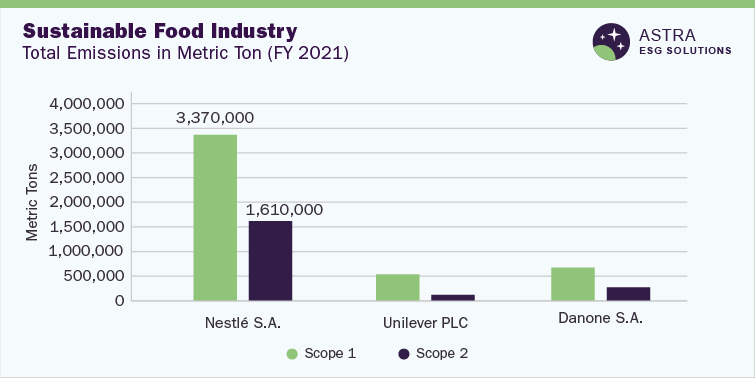

In the environmental pillar, the top three companies are Nestlé S.A., Unilever PLC, and Danone S.A. Unilever PLC reported the lowest scope 1 and scope 2 emissions for 2021. Several initiatives (by Unilever PLC), such as the climate transition action plan to help in strategizing the emission reduction goals, investments in environmentally friendly projects across its operations, and the transition to clean energy, have helped in mitigating its scope 1 and 2 emissions.

In terms of total energy consumption, more than 60% of the profiled companies in the sustainable food industry have disclosed the amount of renewable energy consumed in their operations. Among the top three companies, Danone S.A. reported the lowest energy consumption and has shown its transition to clean energy. The company has introduced carbon funds for improving sustainable practices in rural economies and has stopped deforestation to promote the preservation of carbon in the soil.

While companies in the sector show significant progress in certain areas to promote environmental sustainability, only 30% of the profiled companies possess an ISO 14001 certification. The ISO 14001 certification assures consumers that the products of a particular company are environmentally friendly and sustainable. Out of the top three companies in the environmental pillar, only Nestle S.A. and Danone S.A. have disclosed information regarding ISO 14001 accreditation.

With respect to environmental benchmarking, the following chart compares the scope 1 and scope 2 emissions along with the emission intensity of the top three companies in this category:-

Social Insights

In recent times, the modern sustainable food movement has emerged in response to several social concerns, including the overuse of synthetic chemicals in agriculture, the loss of biodiversity due to deforestation, and the negative impact of industrial food production on health and the planet. This movement entails a wide range of initiatives and practices, including organic farming, regenerative agriculture, archeology, and permaculture, as well as efforts to improve food access and food justice.

In terms of social indicators, companies in the sustainable food industry have the opportunity to improve work-life balance policies, responsible marketing practices, and the disclosure of quality certifications. More than 50% of the companies profiled in our research disclose the above social metrics, thereby providing scope for the other players in the market to improve their disclosure practices.

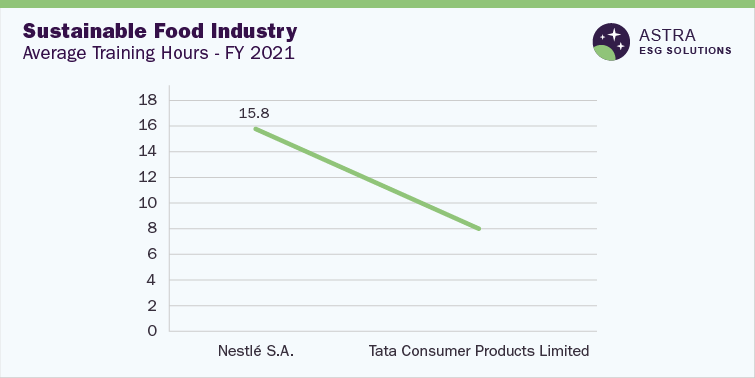

Companies in the sustainable food industry show a strong disclosure performance in terms of disclosing and improving workforce diversity, with 90% of the companies profiled disclosing targets to improve diversity in the workplace. The top three firms in the social pillar were Unilever PLC, Nestlé S.A., and Tata Consumer Products Limited and two of these have targets to improve the representation of women in their workforce, at least by 2025.

Pertaining to human rights in the supply chain, all nine profiled companies have separate supplier codes of conduct and more than 80% of them have incorporated a human rights policy into their supply chain. This shows the commitment of the firms to responsible supply chain practices, helping their suppliers maintain ethical and social transparency.

Among the top three firms, Unilever PLC has an externally disclosed supplier policy that integrates human rights considerations and Nestle S.A. mandates its suppliers to respect and promote human rights in the supply chain and discourage all forms of child labor, forced labor, discrimination, and harassment.

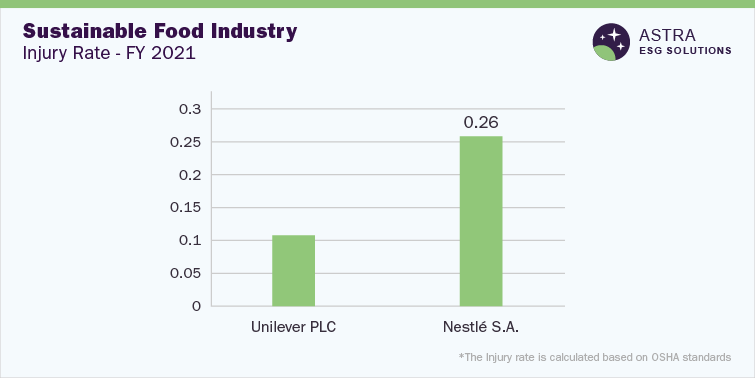

A firm’s lower injury rate indicates the adequate safety standards it has in place, which subsequently augurs well with brand positioning. These include higher productivity, lower insurance costs, and more investment opportunities. According to our research, only 20% of firms profiled have disclosed the injury rate in their operations. Among the top three firms in this pillar, Unilever PLC reported the lowest injury rate, whereas Nestlé S.A. reported the highest injury rate for 2021. In addition, only 20% of firms have made disclosures around the OHSAS 18001 and ISO 45001 certifications, which are Nestlé S.A. and Tata Consumer Products Limited.

With respect to social benchmarking, the below charts compare injury rates and average training hours across the top three companies in this category:-

Governance Insights

In the governance pillar, a wide range of metrics, such as independence of directors, code of business conduct, risk and crisis management, and supply chain management, are taken into consideration and analyzed. All the companies in the sustainable food industry have shown significant commitment to governance disclosure as the average governance disclosure score in this industry is well above 70%.

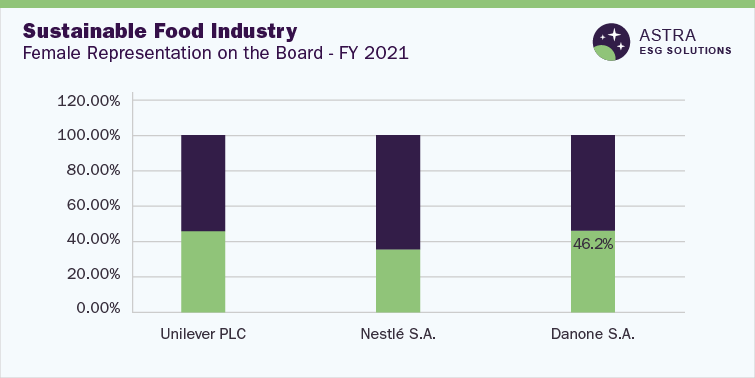

All the companies identified in the sustainable food industry have opportunities to improve their governance disclosure around the representation of female members on their board, succession planning, and in improving supply chain audits, among other factors. More than 50% of the companies profiled in our research have succession plans and have more than 30% of women represented across their boards. In addition, only around 50% of the e companies have established a Business Continuity Plan (BCP) to ensure business sustainability in terms of unplanned events. However, among the top three firms in the governance pillar, which include Unilever PLC, Nestlé S.A., and Danone S.A., all of them have a BCP to protect their supply chain operations from being affected by natural or man-made disasters.

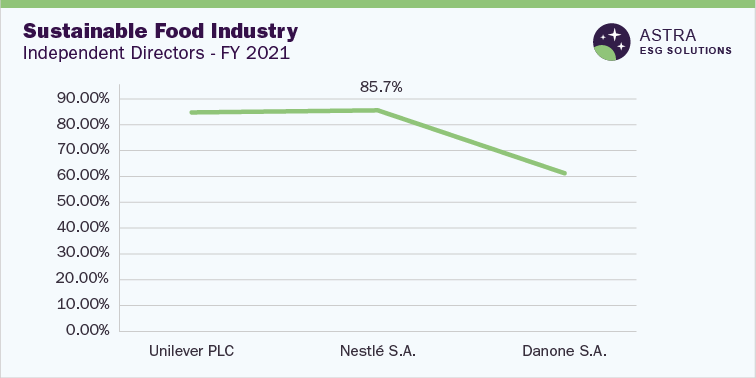

A diverse board structure helps in undertaking innovative and creative ideas, which further helps in strengthening the company’s reputation. Pertaining to independent directors, Nestlé S.A. reported the highest percentage of independent directors, whereas Danone S.A. reported the lowest for 2021.

Cybersecurity plays a crucial role in the protection of employee and customer data; however, only around 50% of the profiled companies have programs or policies that promote cybersecurity. Out of the top three companies of the governance pillar, only two companies have disclosed the cybersecurity programs and policies.

All the companies profiled in this industry have disclosed that they have a code of conduct. Having a comprehensive code of conduct in place helps in monitoring the ethics and compliance of a company’s employees. In essence, Unilever PLC and Nestlé S.A. have a code of conduct that covers key topics, including bribery, conflict of interest, and discrimination, among others.

With respect to the governance benchmarking, the below charts compare the percentage of women on board and the percentage of independent directors on board across the three companies in this category:-

Country level Insights

According to our research, the top five countries identified in the sustainable food industry are Sweden, Japan, Canada, Finland, and Austria. Sweden ranked first as it had almost zero distribution level food loss, highly sustainable water withdrawal and affordability of sustainable and healthy diets. Meanwhile, Japan’s sustainable agriculture and the nutritional impact of its supply chain help it rank second. Canada has been the best-performing country in terms of reducing food loss and food waste and has a food policy to reduce food waste in its operation. Similar to Japan, Finland’s sustainable agriculture has made significant growth and has helped it maintain self-sufficiency in terms of providing cereals, eggs, and poultry. It has also done better than the other countries in terms of sustainability of water withdrawal, effective water management, and positive environmental impact of agriculture.

Chapter 1. Introduction

1.1 Top Countries for the Production and Recycling Waste

1.2 Tax/Policy in Sustainable Agriculture

1.3 Investments and Start-Ups in Sustainable Agriculture and Sustainable Food Production

1.4 Patents

Chapter 2. Industry Benchmarking

2.1 Overall Industry Disclosure Score

2.2 Disclosure Score Benchmarking

2.3 SWOT Analysis

Chapter 3. Company Profiles

3.1 Unilever PLC

3.2 Nestlé S.A.

3.3 Danone S.A.

3.4 Tata Consumer Products Limited

3.5 Mondelēz International, Inc.

3.6 Kellogg Company

3.7 Sysco Corporation

3.8 Archer-Daniels-Midland Company

3.9 George Weston Limited

Research methodology

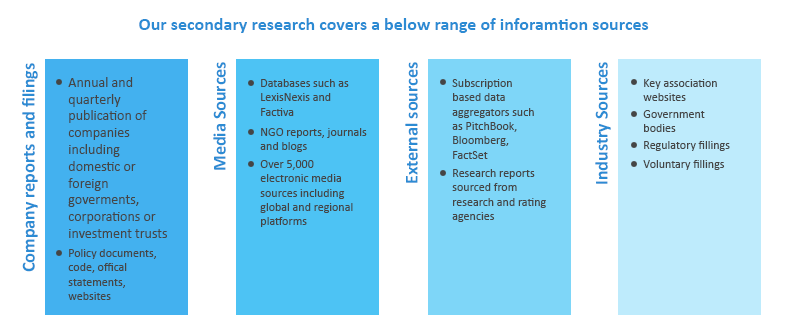

Grand View Research (GVR) employs a holistic and robust research methodology focused on delivering precision. Our ESG key issues are selected following a thorough materiality analysis run by our taxonomy committee. We examine leading business journals relevant to the industry sector and where applicable references are made to a range of sources including regulatory agencies, trade associations, company filings, white papers, and analyst reports during the due diligence on data aggregation. In addition, a recurring theme that remains central to all our research reports remains data triangulation which aims to dive into the market from thematic context, regulation, and industry benchmarking, including SWOT analysis.

Eligibility Criteria and Company Selection

Each public company is curated by our senior researchers following a comprehensive study of their business involvement around a specific theme. The involvement extends to subsidiaries based on at least 50% holding by the parent company. Following this, we analyze fundamental financial indicators, including revenue and market capitalization to ensure a diverse set of companies that fairly represent the sector are included. Additionally, GVR researchers ensure the disclosure level of each company across the material ESG key issues.

Scoring Methodology

Each ESG metric is assigned a specific weight based on its relevance across sectors. Below are the aggregated weights across pillars, which are derived from each metric.

| Environment | Social | Governance |

| 40% | 30% | 30% |

GVR’s proprietary ESG score is calculated using a weighted average method at:

• Key issues level

• Pillar level

• Company level and,

• Theme level

Data Mining

Data is obtained and collated from diverse source points. The data collected is continuously cleansed to ensure that only validated and verifiable sources are analyzed. In addition, data is also mined from a large number of in-house syndicated research reports inventory as well as through paid databases and premium content. During this research report, we conducted multiple primary interviews across the globe supported by our Primary Research Panels through the delivery of a mix of paid and unpaid interviews. We also send and receive responses from a wide section of industry participants through a carefully crafted and comprehensive survey questionnaire. We triangulate these data into quant models and generate qualitative insights. Evolving industry dynamics that shape drivers, restraints, and pricing are also gathered. As a result, the published content includes proprietary data and meaningful insights.

Fundamental ESG data:

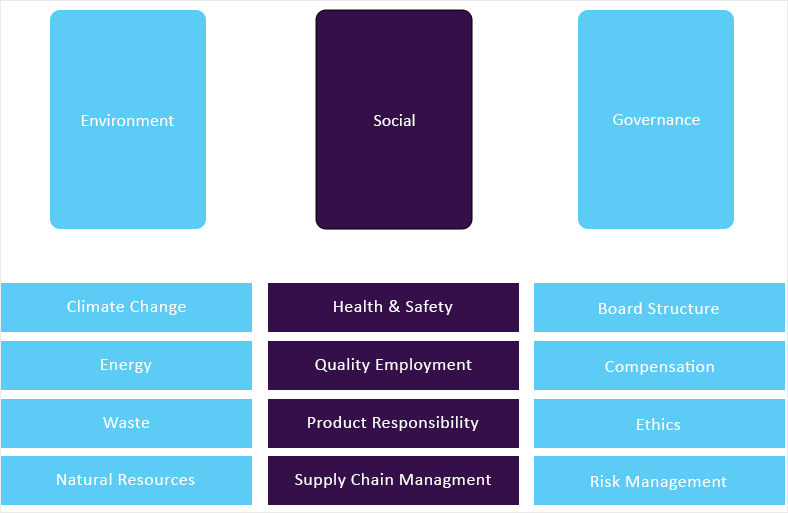

GVR’s ESG taxonomy committee maintains the framework and ensures it is updated quarterly considering market updates and relevance. Framework includes 65+ fundamental ESG metrics that are identified following a thorough materiality assessment. Below is GVR’s ESG Level-I framework:

Alternative ESG data:

GVR also analyzes macro-economic factors that impact or drive the growth of respective sectors. This includes

• Deep dive analysis of policy and regulatory landscape that has potential towards shaping the future of businesses

• Innovation quotient of a sector to gauge prospective evolution of a theme and related opportunities

• Investment scenario, including mergers & acquisition, funding and other deals to assess the investment appetite for a particular theme

• Other market activities, including market size, growth forecasts among others.

Information sources