- Report Summary

- Table of Content

- Methodology

- Request for ESG Consultation

Report Overview

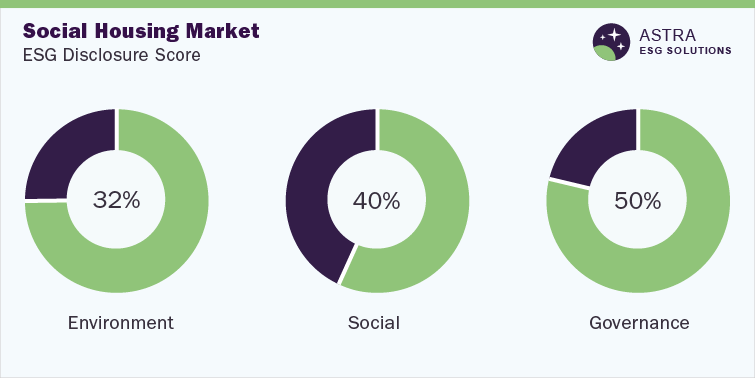

The average ESG disclosure score for the social housing market stands between 30% and 50%. This conclusion has been derived from a detailed analysis of ESG parameters within our robust ESG scoring framework. Our research assessed Henry Boot plc, Mears Group plc, and six other global market leaders.

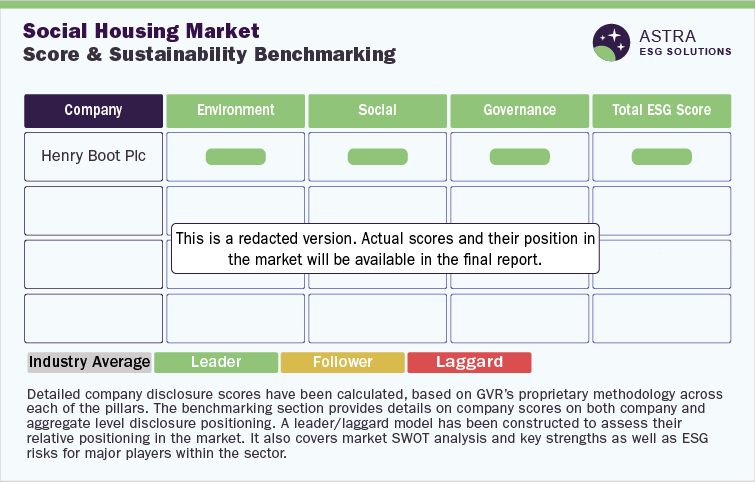

As per the research, only two companies, Henry Boot plc and Mears Group plc, have scored above average industry scores, while four other companies follow ESG reporting & disclosure norms but have scored below the industry average score. Our findings concluded that half of the ESG disclosures have been made around the governance indicators, with Henry Boot plc leading the sector.

Environmental Insights

From an environmental perspective, social housing does not just involve a single unit but also the surrounding area. This involves reorganizing and rebuilding spaces with sustainability norms and promoting real estate powered by social factors. The housing & construction industry has been contributing to environmental harm for ages, from utilizing unsustainable materials to mindless urbanization. Social housing schemes are socially and environmentally sustainable. In terms of social sustainability, they provide good quality homes that are affordable and improve the health & well-being of people. In terms of environmental sustainability, they help achieve CO2 emission reduction goals and are constructed in accordance with biodiversity standards.

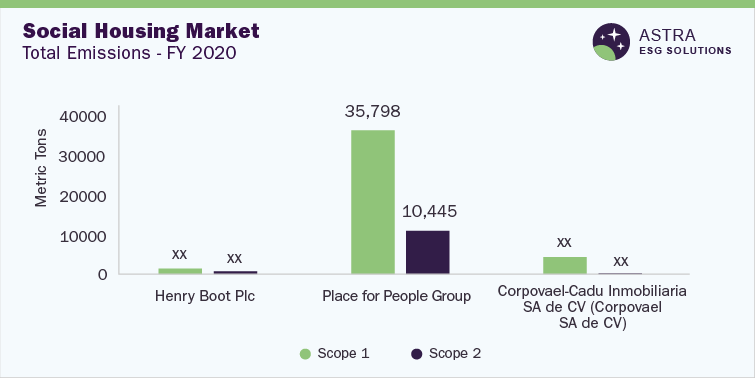

Henry Boot Plc, Places for People Group, and Corpovael – Cadu Inmobiliaria SA de CV (Corpovael) are the top three companies in terms of environmental disclosure. Among the top three companies, it was noticed that Places for People Group had the highest scope 1 emissions, while Henry Boot plc had the lowest. Places for People Group also reported the highest scope 2 emissions, whereas Corpovael reported the lowest scope 2 emissions. Places for People has not reported data for its energy consumption & energy intensity, so only the top two companies were benchmarked. Henry Boot Plc reported the lowest intensity, and Corpovael reported the highest energy consumption.

Sites owned by Henry Boot Plc and some sites owned by Places for People Group have been reaccredited with the ISO 14001 certification. Corpovael has not disclosed any information regarding environmental certifications and accreditation. Predominantly, only Henry Boot Plc has highlighted climate change as one of its key risk areas. At the same time, Corpovael and Places for People Group have disclosures on body oversight for climate change. Corpovael has adopted a clear & proactive approach to water management and successfully reduced water consumption by 82% in 2020. However, Henry Boot Plc and People for Places have not reported any initiatives for water management.

Social Insights

Social housing systems provide a broader and more socially inclusive community. The objective of social housing is to make housing more predictable & affordable so that disposable household income is available for basic amenities, healthcare, transportation, etc. Social housing is also considered a more secure form of tenancy than private renting. According to the concept of social housing, a person is able to live in a social housing property for the rest of their lives as long as they do not break the rules of the tenancy. In addition, it is socially inclusive as it brings communities together against structural issues in housing.

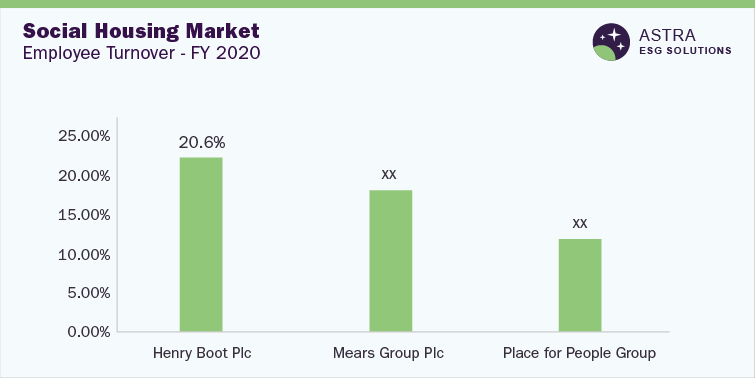

Among the top three companies, Mears Group Plc reported the highest gender pay gap, while Places for People Group reported the lowest gender pay gap. This indicates Places for People’s proactive approach toward gender equality & pay parity. However, Places for People reported a higher voluntary turnover rate, as against Henry Boot Plc and Mears Group Plc. In terms of employee turnover (FY 2020), Henry Boot Plc had the highest turnover rate in comparison to its competitors, with Places for People Group reporting the lowest emissions.

As per our research, Mears Group Plc has retained its ISO 45001 certification of FY 2020, and Henry Boot Plc is OHSAS 18001 certified. However, Places for People Group has not disclosed any information regarding its safety certification. Henry Boot Plc and Places for People Group have separate supplier codes of conduct in place, as they consider suppliers to be an integral part of their business operations and require them to adhere to basic human rights practices.

Governance Insights

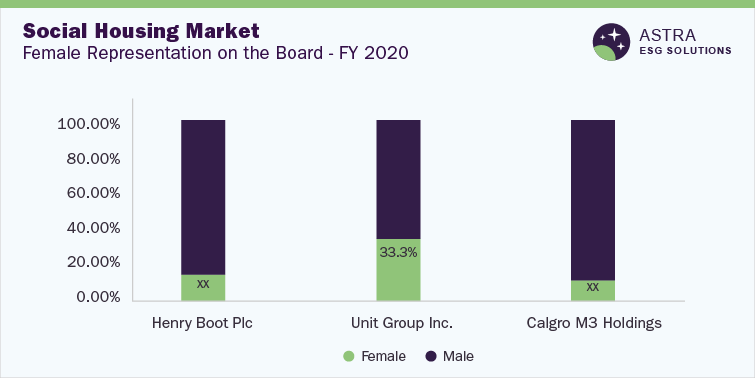

Henry Boot Plc, Uniti Group Inc., and Calgro M3 Holdings emerged as the top three companies among the eight companies assessed in the social housing market. Uniti Group had the highest percentage of women board members, while Calgro M3 Holdings reported the lowest percentage. Uniti Group also reported the highest percentage of independent directors, while Henry Boot Plc had the lowest percentage. The high number of directors on the board indicates greater company credibility.

The top three companies have a robust cybersecurity architecture, including data protection policies, data management systems, and standards for best practices. These market players frequently evaluate their access control, security policies, and data storage. Henry Boot Plc, which is the top company in terms of governance scoring, has a separate ethics policy in place, which specifies the required standards to be followed by the organization’s members. Following these policies is imperative for all parties while adhering to human rights. Henry Boot Plc and Calgro M3 Holdings highly value succession planning while implementing human capital management policies. Uniti Group has not disclosed any information related to policies or procedures for data protection to enhance governance.

Country-level Insights

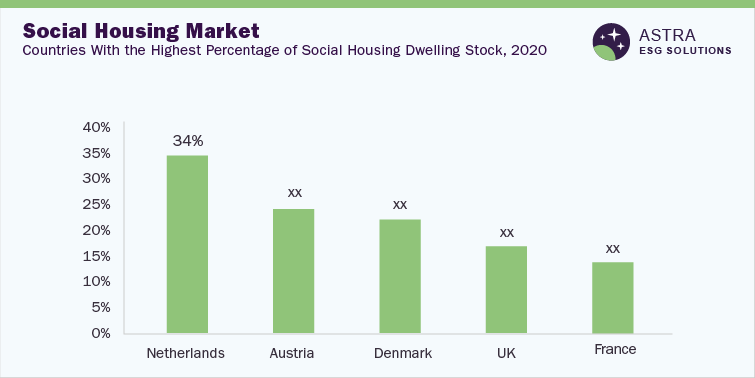

As per the 2020 OECD Social Housing Data, the Netherlands, Austria, Denmark, the UK, and France had the highest number of social housing dwellings. Meanwhile, countries from the Nordic region, including Iceland & Ireland, constitute 10% of social housing dwelling stock compared to the global housing stock.

Social housing in European countries triumphs any other region in the world, of which the Netherlands has the largest housing stock. This includes municipalities and nonprofit & limited-profit housing associations. The Netherlands is followed by Austria, which makes up for the second-largest social housing stock, which has evolved over time. In Austria, social housing is handled by various nonprofit organizations in conjunction with local governments. The third spot on the list belongs to Denmark, whose infrastructure relies on public funding. Local municipalities take charge of social housing projects, ensuring accessibility to a broad range of individuals in the market. Similarly, France is governed by regional & municipal authorities and nonprofit landowners. These habitations are built with minimum expense, and the rental price is quite affordable. Last on the list is the UK, which is reported to have a medium-sized social housing sector. Local councils and nonprofit organizations offer a majority of social housing.

Market Overview

Among the list of OECD countries, around 6% to 7% of the total housing stock is said to be social housing units. The monetary support for social housing projects varies from country to country. Social mixing, which is one of the major objectives of social housing, is popular across many countries. The sector has become increasingly occupied by the low-income & vulnerable communities. Many countries have started initiating major building revitalization projects to improve the quality of social dwellings and the neighboring areas.

Investments in the industry have increased multifold due to the COVID-19 pandemic. This is reinforced by the EU’s Renovation Wave Initiative, a part of the European Green Deal. The pandemic put the housing crisis in the spotlight, bringing out the affordability & accessibility gaps arising because of poor economic conditions. Different countries employ different approaches to social housing. Social housing may be developed and administered by public, private, or non- or limited-profit entities depending on the country.

Chapter 1. Introduction of Sustainability in Social Housing

1.1 A Global Perspective on Social Housing

1.2 Tax Rebate/Incentive Policy in Social Housing Across the Top Countries

1.3 Social Housing – Investments/Policies Across the Top Countries

1.4 Technology Innovations in Social Housing, Including Sustainably Designed Projects

1.5 Social Housing Patents

1.6 Social Housing Mergers, Deals, and Acquisitions

Chapter 2. Industry Benchmarking

2.1 Overall Industry Disclosure Score

2.2 Disclosure Score Benchmarking

2.3 SWOT Analysis

Chapter 3. Company Profiles

3.1 Henry Boot Plc

3.2 Mears Group Plc

3.3 Places for People Group

3.4 Corpovael – Cadu Inmobiliaria SA de CV (Corpovael SA de CV)

3.5 Uniti Group Inc.

3.6 Calgro M3 Holdings

3.7 Metropolitan Thames Valley

3.8 Clarion Housing Group

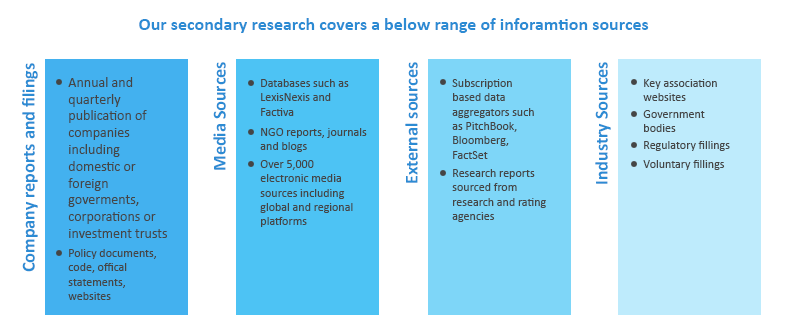

Research methodology

Grand View Research (GVR) employs a holistic and robust research methodology focused on delivering precision. Our ESG key issues are selected following a thorough materiality analysis run by our taxonomy committee. We examine leading business journals relevant to the industry sector and where applicable references are made to a range of sources including regulatory agencies, trade associations, company filings, white papers, and analyst reports during the due diligence on data aggregation. In addition, a recurring theme that remains central to all our research reports remains data triangulation which aims to dive into the market from thematic context, regulation, and industry benchmarking, including SWOT analysis.

Eligibility Criteria and Company Selection

Each public company is curated by our senior researchers following a comprehensive study of their business involvement around a specific theme. The involvement extends to subsidiaries based on at least 50% holding by the parent company. Following this, we analyze fundamental financial indicators, including revenue and market capitalization to ensure a diverse set of companies that fairly represent the sector are included. Additionally, GVR researchers ensure the disclosure level of each company across the material ESG key issues.

Scoring Methodology

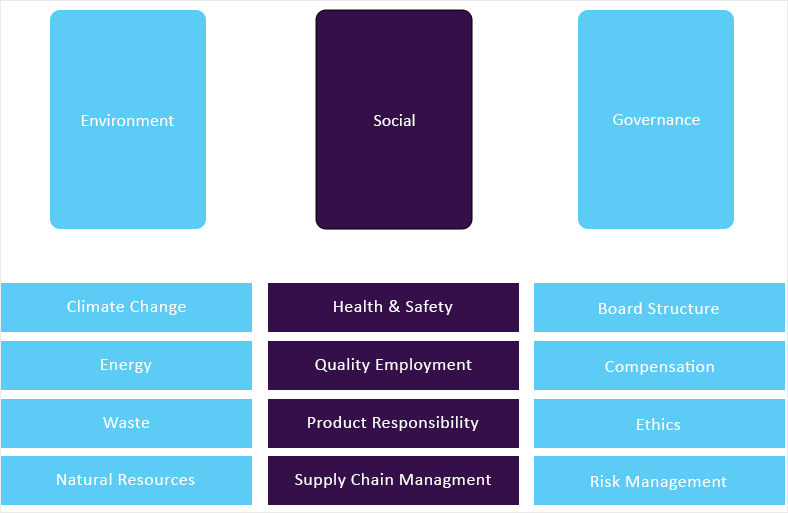

Each ESG metric is assigned a specific weight based on its relevance across sectors. Below are the aggregated weights across pillars, which are derived from each metric.

| Environment | Social | Governance |

| 40% | 30% | 30% |

GVR’s proprietary ESG score is calculated using a weighted average method at:

• Key issues level

• Pillar level

• Company level and,

• Theme level

Data Mining

Data is obtained and collated from diverse source points. The data collected is continuously cleansed to ensure that only validated and verifiable sources are analyzed. In addition, data is also mined from a large number of in-house syndicated research reports inventory as well as through paid databases and premium content. During this research report, we conducted multiple primary interviews across the globe supported by our Primary Research Panels through the delivery of a mix of paid and unpaid interviews. We also send and receive responses from a wide section of industry participants through a carefully crafted and comprehensive survey questionnaire. We triangulate these data into quant models and generate qualitative insights. Evolving industry dynamics that shape drivers, restraints, and pricing are also gathered. As a result, the published content includes proprietary data and meaningful insights.

Fundamental ESG data:

GVR’s ESG taxonomy committee maintains the framework and ensures it is updated quarterly considering market updates and relevance. Framework includes 65+ fundamental ESG metrics that are identified following a thorough materiality assessment. Below is GVR’s ESG Level-I framework:

Alternative ESG data:

GVR also analyzes macro-economic factors that impact or drive the growth of respective sectors. This includes

• Deep dive analysis of policy and regulatory landscape that has potential towards shaping the future of businesses

• Innovation quotient of a sector to gauge prospective evolution of a theme and related opportunities

• Investment scenario, including mergers & acquisition, funding and other deals to assess the investment appetite for a particular theme

• Other market activities, including market size, growth forecasts among others.

Information sources