- Report Summary

- Methodology

- Request for ESG Consultation

Environmental, Social and Governance (ESG) in Kitchenware Industry

Integrating ESG into decision making and business strategies contributes to an effective due diligence and a better investment decision for the company as well as relevant stakeholders. Companies which are focused on the kitchenware industry have been disclosing ESG data and strategies.

The industry has been growing due to rapid urbanization and increasing population. Companies have been focusing on innovation like smart kitchens which are eco friendly. Product quality and safety is another area of interest for many consumers who are inquisitive of certain safety certificates. Along with this, hazardous materials compliance like BPA free products have been preferred by consumers. Companies are also focusing on eliminating packaging waste by introducing sustainable or circular packaging. Companies also provide training and development procedures also to maintain sustainable practices in a kitchen.

The United Nations’ Sustainable Development Goals (UN SDGs) is a comprehensive framework that helps companies in this market obtain a perspective on the impact of their products and operations on ESG parameters.

ESG Trends

The main ESG trends fall under both environmental and social aspects for this segment. The companies are focusing onproduct innovation (SDG 9- Industry, Innovation, and Infrastructure), for example one the companies have committed on using sustainably sourced material for their product and have introduced Eco straw which are made up of circular polymers. Circular polymers are made by process of mixed single-use plastic waste that was destined for disposal, breaking it down to its molecular level and recreating it into a high-quality food grade plastic. It is first material aligned with commitment to address the global challenge of single-use plastic waste. Companies are also introducing circularity and sustainable packaging measures, one of the companies certifies around 96% of products are circular in nature. In addition to this, companies have made a commitment to use recycled eco-friendly airbags instead of non- recyclable polystyrene. As most of end users or consumers are bothered about product quality and safety, companies have their commitment for ISO 9001:2015 alongside other safety certificates like Bisphenol A(BPA) free which is chemical used in production of polycarbonate products and can mimic action of estrogen level with sufficient dose. Along with this companies are also certified with legislation like Registration, Evaluation and Authorization of Chemicals (REACh) and Restriction of Hazardous Substances (RoHS) which are intended for chemical and hazardous substances legislation.

ESG Challenges

This segment faces various challenges; starting with compliance regulation companies must have certification which might be affordable considering all products. Auditing and certifying products with certificates mentioned is also a time-consuming process too. Legislation like IS 14756: 2000 for stainless steel and schedule 4 as per Food and safety standard is a mandatory requirement for kitchen utensils. Even though companies have focused on minimizing non-recyclable materials like polystyrene and polycarbonates, there is prevailing use of such materials in the market which have negative environmental impact. Companies must focus on ergonomic aspects along with the design due various hazards it could cause to users, for example sharp edges can cause cuts, pressure valve issues can even cause severe injury or even fatality. Innovation must include ergonomics and minimize hazards with design and material changes.

Growth of the Kitchenware Market

Overall, the Kitchenware market is having a promising future due rapid urbanization, increasing number of households and migration to different places. Moreover, the kitchenware market has been implementing different innovative and sustainable solutions which have significant impact for growth and stability of the company in the market. The company had a market cap of 62 billion by 2018 and expected to have a compound annual growth rate of 5% by 2025 on a global level.

Key Companies in this theme

• Boffi

• Scavolini S.p.a

• Tupperware

• Viners

• Chasseur

• Kenwood Limited

• TTK Prestige Ltd.

• Miele

• Whirlpool Corp.

• Kitchenaid

Scope of Kitchenware Industry ESG Thematic Report

• Macro-economic and ESG-variable analysis of the industry, including regulatory, policy, and innovation landscape

• Key insights on infrastructure developments and ESG issues affecting the theme

• Identify key initiatives and challenges within the industry

• Identify ESG leaders within the industry

• Understand key initiatives and the impact of companies within the sector to fuel an informed decision-making process

• Analysis of industry activities based on multi-media sources, including significant controversies and market sentiment

Key Benefits of this Report

• Developing a comprehensive understanding of macro-economic, Policies & Regulations and innovations affecting the Kitchenware space, globally

• Key insights into environmental developments and ESG issues affecting the theme

• Identifying ESG risks and opportunities to business among leading players in the Kitchenware

• Obtaining a clear and relevant understanding of company actions, progress, and impact and find opportunities for investment into the sector

Research methodology

Grand View Research (GVR) employs a holistic and robust research methodology focused on delivering precision. Our ESG key issues are selected following a thorough materiality analysis run by our taxonomy committee. We examine leading business journals relevant to the industry sector and where applicable references are made to a range of sources including regulatory agencies, trade associations, company filings, white papers, and analyst reports during the due diligence on data aggregation. In addition, a recurring theme that remains central to all our research reports remains data triangulation which aims to dive into the market from thematic context, regulation, and industry benchmarking, including SWOT analysis.

Eligibility Criteria and Company Selection

Each public company is curated by our senior researchers following a comprehensive study of their business involvement around a specific theme. The involvement extends to subsidiaries based on at least 50% holding by the parent company. Following this, we analyze fundamental financial indicators, including revenue and market capitalization to ensure a diverse set of companies that fairly represent the sector are included. Additionally, GVR researchers ensure the disclosure level of each company across the material ESG key issues.

Scoring Methodology

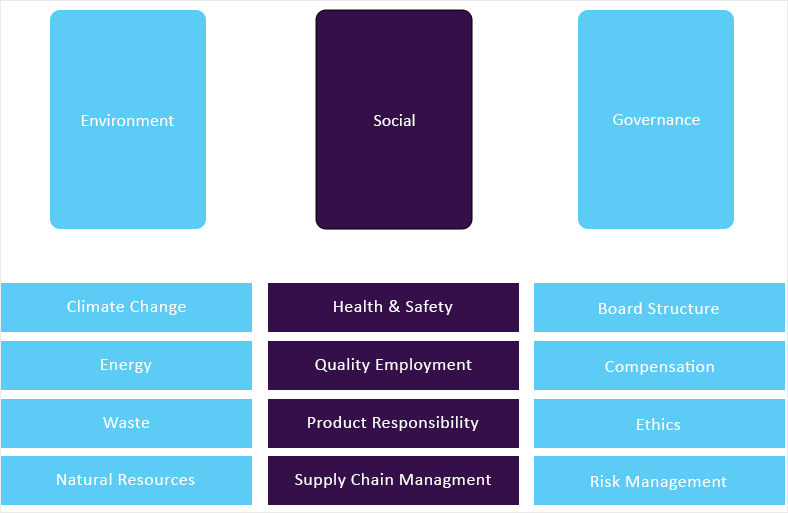

Each ESG metric is assigned a specific weight based on its relevance across sectors. Below are the aggregated weights across pillars, which are derived from each metric.

| Environment | Social | Governance |

| 40% | 30% | 30% |

GVR’s proprietary ESG score is calculated using a weighted average method at:

• Key issues level

• Pillar level

• Company level and,

• Theme level

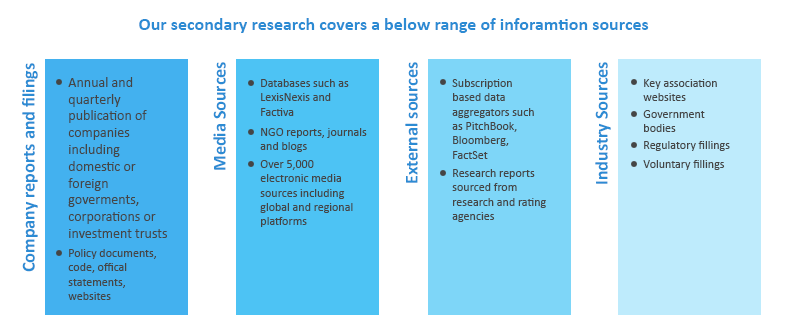

Data Mining

Data is obtained and collated from diverse source points. The data collected is continuously cleansed to ensure that only validated and verifiable sources are analyzed. In addition, data is also mined from a large number of in-house syndicated research reports inventory as well as through paid databases and premium content. During this research report, we conducted multiple primary interviews across the globe supported by our Primary Research Panels through the delivery of a mix of paid and unpaid interviews. We also send and receive responses from a wide section of industry participants through a carefully crafted and comprehensive survey questionnaire. We triangulate these data into quant models and generate qualitative insights. Evolving industry dynamics that shape drivers, restraints, and pricing are also gathered. As a result, the published content includes proprietary data and meaningful insights.

Fundamental ESG data:

GVR’s ESG taxonomy committee maintains the framework and ensures it is updated quarterly considering market updates and relevance. Framework includes 65+ fundamental ESG metrics that are identified following a thorough materiality assessment. Below is GVR’s ESG Level-I framework:

Alternative ESG data:

GVR also analyzes macro-economic factors that impact or drive the growth of respective sectors. This includes

• Deep dive analysis of policy and regulatory landscape that has potential towards shaping the future of businesses

• Innovation quotient of a sector to gauge prospective evolution of a theme and related opportunities

• Investment scenario, including mergers & acquisition, funding and other deals to assess the investment appetite for a particular theme

• Other market activities, including market size, growth forecasts among others.

Information sources