The Rise of ESG Initiatives and the Impact of Trump’s Rollback of Environmental Regulations

In recent years, there has been a growing emphasis on stakeholder capitalism and long-term value creation, a shift that was accelerated by the COVID-19 pandemic and has led to a more inclusive approach to capitalism. While environmental concerns have largely driven the growth of ESG initiatives, the social aspect has also gained increasing attention. ESG investing has experienced a dramatic rise, with global sustainable investments now exceeding $30 trillion—a 68% increase since 2014 and a tenfold rise since 2004. This surge reflects increased attention from consumers, governments, and investors, who recognize that strong ESG practices can protect a company’s long-term success, indicating ESG is more than just a trend.

The Trump administration opposed efforts to limit climate change, prioritizing economic interests and reflecting a preference for domestic production and protectionist policies. This stance reflects his administration’s focus on pollical strategies that resonate with popular sentiment as well as prioritizing economic interests through protecting local industries and promoting domestic production. It is also consistent with deep rooted traditions of US isolationism and rejection of multilateral institutions, such as the Kyoto Protocol, that could influence or constrain US actions, particularly when such actions can affect the economy.

After winning the 2017 election, Trump immediately impacted U.S. environmental policy, announcing withdrawal from the Paris Agreement and halting climate finance contributions. The withdrawal took effect on November 4, 2020. Prioritizing geopolitics over climate, Trump ended U.S. financial contributions to the GCF, scrapping the remaining $2 billion pledge. His administration also rolled back over 125 environmental protections, easing power plant waste regulations, weakening appliance efficiency standards, reducing mine safety oversight, and approving seismic drilling in an Alaska wildlife refuge.

Center for Climate and Energy Solutions sent a letter to the President, which was signed by Apple, BHP Billiton, BP, DuPont, General Mills, Google, Intel, Microsoft, National Grid, Novartis Corporation, PG&E, Rio Tinto, Schneider Electric, Shell, Unilever and Walmart. These 16 Fortune 500 companies are among the top U.S. retail, tech, power, energy, mining, pharmaceutical, manufacturing, and consumer goods companies, with a combined market capitalization of nearly $3.4 trillion. The letter stated, “By committing all countries to action, the agreement expands markets for innovative clean technologies, generating jobs and economic growth,” the letter says. “U.S. companies are well positioned to lead, and lack of U.S. participation could put their access to these growing markets at risk.’’ In addition, Scott Vaughan, President from International Institute of Sustainable Development stated, “While we are deeply disappointed by this ill-informed decision, we are also heartened by the immediate response from other major countries determined to proceed with climate action”.

Upon this announcement, more than 4,000 mayors, governors, university presidents and business leaders signed the “We Are Still In” declaration, committing to meet the emissions-reduction targets set in the Paris Agreement and continue engaging with the international community. Many states have enacted ambitious climate policies. For instance, the 24 states and territories that comprise the bipartisan U.S. Climate Alliance, representing 54% of the U.S. population and 57% of the U.S. economy, have collectively committed to achieving net-zero emissions no later than 2050. Several studies suggest that if the US were to disengage from global climate efforts and continue as a high-emitting economy for an extended period, other countries— including developing nations— would face the need to make much greater efforts to reduce emissions in order to meet the same temperature targets. This would result in significantly higher costs for the global economy. Consequently, other studies estimate that near-term emissions trends will remain flat, no matter what the current US Administration does or does not do, and that President Trump’s impact on cumulative US emissions will be small if a subsequent administration gets back onto a trajectory towards an 80% reduction. Furthermore, research indicates that the Trump Administration’s support for the coal and oil industry, as well as gas production, will not halt the ongoing transition to clean energy. According to Jotzo, Depledge, & Winkler (2018), “the US Administration simply does not have the power to reverse this trend, and if it did, doing so would cause economic harm to the country.”

The Inflation Reduction Act and Its Role in Advancing Clean Energy Despite a Trump Presidency

Upon assuming office, the Biden administration rejoined the Paris Agreement and established ambitious climate goals, aiming for a 61-66% reduction in greenhouse gas emissions by 2035. The administration also pledged $1 billion to the Green Climate Fund to support global climate action. The Inflation Reduction Act (IRA) of 2022, which aims to meet climate goals, strengthen energy security, create jobs, and reduce costs, is a key achievement. Combined with the Bipartisan Infrastructure Law, which seeks to replace thousands of transit vehicles with low-emission alternatives, these efforts are projected to cut U.S. GHG emissions by 41% by 2023 from 2005 levels. As anticipated, in the first two years following the IRA, businesses revealed $130 billion in investments across 338 major clean energy and clean vehicle projects, which are projected to generate at least 110,000 jobs. These made the Act the most ambitious investment in combating the climate crisis in world history. For more detailed information on the projections, please see the below data on total investments into and annual jobs supported by clean energy projects, detailed by energy sector.

| Sector | Total Construction Phase Jobs (Annual jobs for 5 years) | Annual Operations Phase Jobs (Annual jobs for lifetime of projects) | Sector | Announced Capital Investment ($billions) | Extrapolated Capital Investment ($billions) | Total Capital Investment ($billions) | Annual Operational Investment ($billions) |

| Solar | 66,736 | 21,882 | Solar | $15.94 | $6.93 | $22.87 | $2.47 |

| Wind | 13,447 | 14,871 | Wind | $3.97 | $1.38 | $5.35 | $1.66 |

| EV | 266,673 | 78,276 | EV | $79.22 | $9.22 | $88.44 | $8.84 |

| Electric T&D | 6,626 | 2,502 | Electric T&D | $1.82 | $0.51 | $2.33 | $0.33 |

| Battery Storage | 84,470 | 22,798 | Battery Storage | $23.27 | $6.87 | $30.14 | $3.17 |

| Clean Fuels | 29,093 | 13,639 | Clean Fuels | $6.06 | $6.85 | $12.90 | $1.07 |

| Total | 467,045 | 153,969 | Total Capital Investment | $130.27 | $31.77 | $162.04 | $17.54 |

Table: Overall investments and annual jobs supported by clean energy projects

Source: E2 (2024)

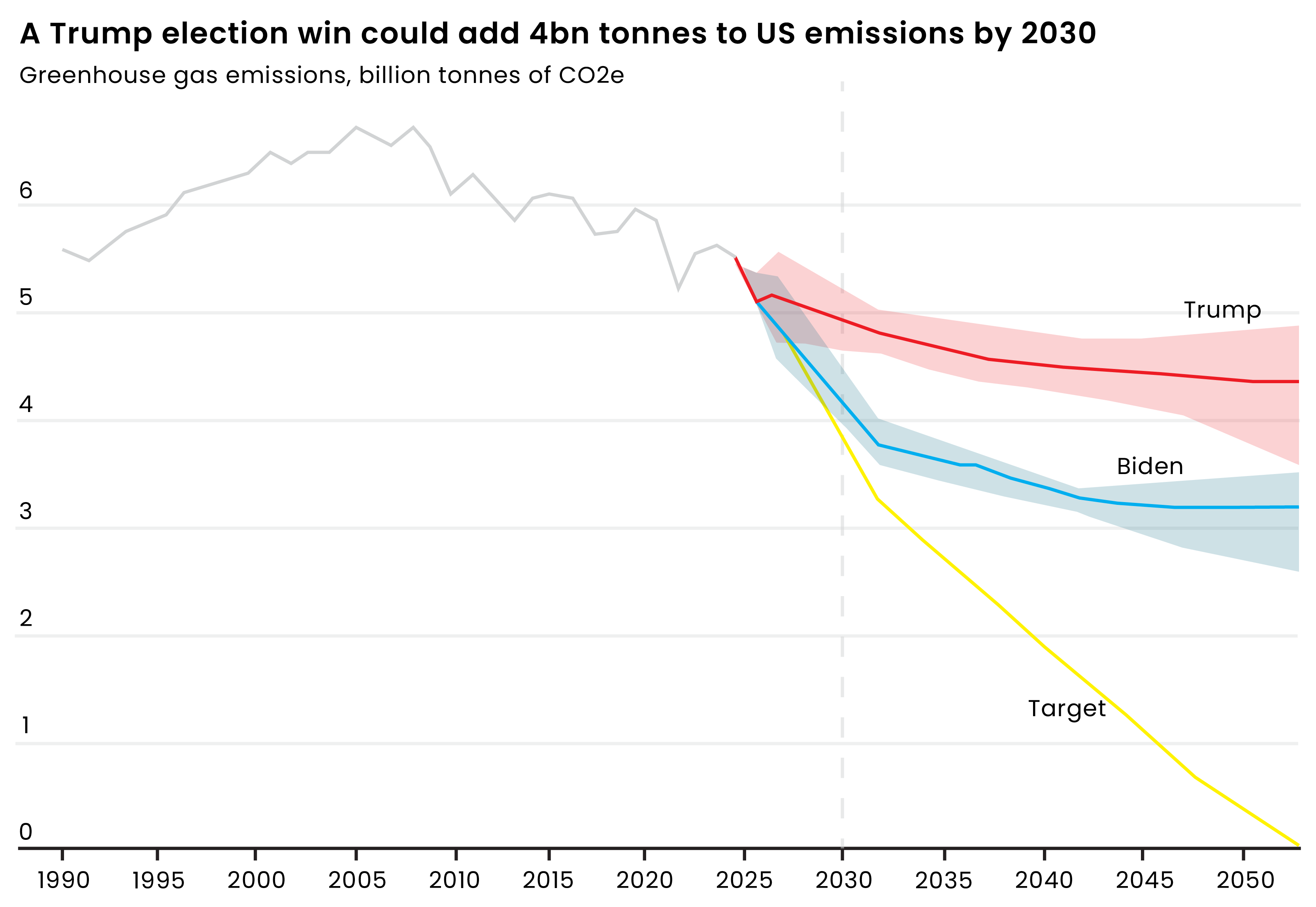

Following his second victory, Trump has promised to reverse many environmental regulations and shift America’s energy policy back toward the fossil fuels that are contributing to the climate crisis. Trump is looking to undo federal mandates to reduce vehicle emissions and billions in consumer tax credits for clean energy projects and electric cars, which were part of Biden’s 2022 Inflation Reduction Act — even though, as stated above, clean energy and EV projects have created tens of thousands of new jobs in the last few years. According to some studies, this could lead to an increase of 4 billion tonnes of carbon dioxide in US emissions by 2030, relative to Biden’s plans. This would, based on current estimates, cause global damages exceeding USD 900 billion. Additionally, the US is likely to miss its international climate goals by a significant margin, with emissions projected to be only 28% below 2005 levels by 2030. According to a recent Carbon Brief Analysis, “If Biden is re-elected, emissions would fall to around 43% below 2005 levels”.

Chart: Carbon Brief Analysis of how a trump election win could increase US GHG emissions

Source: Carbon Brief Analysis (2024)

However, even with roll backs, the underlying momentum and the progress made possible by the Inflation Reduction Act and Bipartisan Infrastructure Law will continue to propel clean energy forward while local, state and private sector leaders carry the torch even further.

According to WRI (2024), “the IRA has already created 330,000 jobs, with at least 354 clean energy projects announced across 40 states and investments exceeding $265 billion”. Even oil companies have urged Trump to maintain certain Inflation Reduction Act provisions for renewable fuels, carbon capture and hydrogen. Moreover, corporates have come a long way in the U.S. in recent years, and progress is likely to continue even under a Trump presidency. For example, nearly half of the country’s leading companies have a net-zero emissions target. “Thousands of businesses have joined initiatives like the We Mean Business coalition and America Is All In initiative”.

Moreover, solar and wind energy are increasingly reliable. According to UCLA (2024), “the transportation sector is electrifying, with automakers offering 117 new electric vehicle models to consumers, making massive investments in transitioning to EVs and making those investments in the United States”. The global push is even bigger, especially in Europe and China. While Trump may slow down progress, a return to fossil fuel dominance seems unlikely.

Should Trump withdraw from the Paris Agreement, the importance of ESG initiatives remains undeniable. Numerous sectors within American society, including businesses and communities, are committed to sustainability, ensuring that the U.S. will continue addressing global challenges, regardless of the administration’s approach to climate action. The future of climate action isn’t dependent on one individual or administration — it’s a movement driven by collective action, industry innovation, and an unwavering resolve for the planet’s well-being. According to WRI (2024), much of America is still committed to creating a safe and prosperous future — even if its leadership isn’t.