Introduction to CBAM

The European Union established a framework called “Carbon Border Adjustment Mechanism” (CBAM) in 2023, which is part of the “Fit for 55 package”, a proposal to reduce Greenhouse Gas (GHG) emissions in the EU by 55% by 2030. It is designed to impose a fair price on carbon emissions from carbon-intensive goods entering the EU. CBAM compliments the EU Emission Trading Scheme (EU ETS), it is a carbon market, initiated to combat the challenge of rising GHG emissions in the EU, operating on a ‘cap-and-trade’ foundation. By aligning the carbon price on imports with domestic production, the framework ensures the carbon price of imports is equivalent to the carbon price of the EU domestic production. It eventually aims to cover more than 50% emissions in the EU ETS.

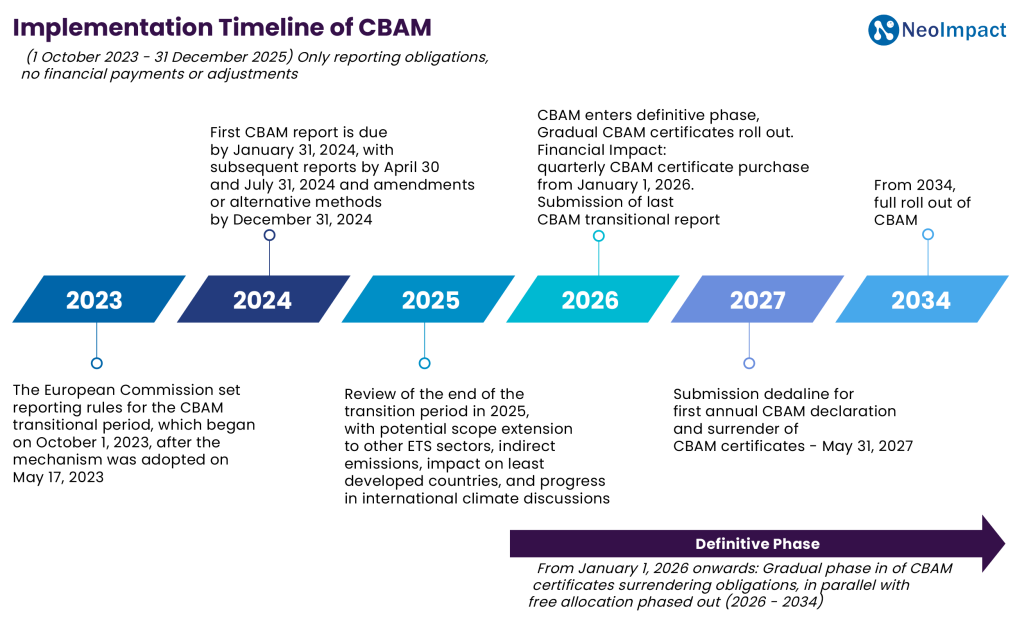

CBAM currently focuses on industries with significant carbon emissions, like hydrogen, fertilizers, steel, aluminium, cement and electricity by reason of their larger emissions contributions due to their energy-intensive processes and will expand coverage by 2030. The mechanism is set to fully apply in 2026, with a transitional phase from 2023 to 2025, aligning with the EU ETS phase-out of free allowances.

Importance of CBAM

By placing a carbon price on imports, CBAM encourages non-EU countries to adopt cleaner production practices, driving global emissions reduction. Additionally, it supports the EU’s ambitious climate goals, including the achieving of carbon neutrality by 2050 and further ensures that imported goods have same environmental standards as of domestic products. This helps create an equal opportunity, incentivizing both domestics and international producers to lower their carbon footprints, ultimately contributing to the global effort to combat climate change.

According to the Organization for Economic Co-Operation and Development (OECD) research, the increase in carbon price and removing free allowances in EU ETS would reduce emissions by 11.7% within EU CBAM industries while increasing emissions outside EU, indicating carbon leakage. The introduction of Carbon Border Adjustment Mechanism leads to a reduction of emissions in EU region and partner countries as well. It is estimated that 175 million tonnes of CO2 emissions reduction within EU region would be partially offset by an increase of 34 million tonnes in partner countries emissions, corresponding to carbon leakage rate of 19.2%. The shift in trade patterns, by rerouting the EU imports to lesser emission intensive sources is estimated to reduce production in high emission economies, leading to 36% increase in global emission reduction in contrast to a scenario without the introduction of CBAM and free allowances, which might increase emissions by 29%. With the EU regulatory changes and implementation of CBAM across all industries, a 0.5% reduction in global emissions is anticipated.

CBAM Compliance Mechanism

The CBAM is being implemented in two phases – the transitional phase and the definitive phase. The transitional phase which lasts from October 1, 2023, to December 31, 2025 will require importers to submit quarterly CBAM reports detailing the total quantity of goods imported, the embedded direct and indirect emissions, and the figure of any carbon price paid in the country of origin for these emissions. In this phase, verification of emissions by an EU-accredited verifier is not required and no CBAM certificates are needed.

Following the transitional phase, the definitive phase begins on January 1, 2026. This phase introduces more stringent requirements: Importers will need to submit annual CBAM declaration containing the total quantity of imported goods, total embedded emissions (verified by an EU-accredited verifier), total number of CBAM certificates surrendered, and the effective carbon price paid in the country of origin. From 2026 onwards, EU importers must register, purchase CBAM certificates, report emissions, and surrender certificates annually. Deductions in carbon prices will be made if a carbon price is paid during production. The price of the certificates will fluctuate based on the weekly average auction price of EU ETS allowances expressed in €/tonne of CO2 emitted.

Non-compliance during either phase will result in penalties. Companies failing to submit reports or submitting incorrect/incomplete reports (that are not corrected upon request) will face fines ranging from EUR 10 to EUR 50 per tonne of unreported emissions. This penalty amount will increase yearly in line with the European consumer price index.

Potential Impact of CBAM on Businesses

The CBAM is expected to significantly reshape global trade and production patterns. Its phased implementation, coupled with the phasing out of EU ETS-free allowances, may initially lead to price increases for CBAM goods within the EU, potentially impacting downstream products. While theoretically priced into current EU allowance markets, a lack of awareness among organizations may cause short-term trade shifts favoring lower-emission imports. This could initially benefit non-EU producers transporting high-emission goods in markets with less stringent carbon policies. However, the CBAM incentivizes global decarbonization by rewarding cleaner production for access to the EU market. Anticipation of similar CBAMs in other jurisdictions, like the UK, and potential carbon pricing adjustments in export-heavy nations further strengthens this trend. Ultimately, the CBAM encourages countries to adopt stronger climate policies to mitigate carbon leakage, maintain competitiveness, and potentially leverage credit mechanisms within the CBAM framework.

Benefits and Challenges of Implementing CBAM for EU and Non-EU Countries

The CBAM is a key tool for combating carbon leakage and driving global decarbonization. For the EU, CBAM protects domestic industries from unfair competition and helps achieve climate goals. However, it also presents challenges, including navigating trade disputes, coordinating supply chains, getting embedded emission data, managing market impacts, and supporting industry compliance.

Non-EU countries face both opportunities and challenges. CBAM can incentivize cleaner production and create competitive advantages for those embracing sustainability. Conversely, it imposes administrative burdens, potential cost increases, and the risk of reduced EU market access for non-compliant businesses.

CBAM’s wider adoption hinges on balancing its environmental objectives with its economic and trade implications for both the EU and its trading partners.

Opportunities that CBAM presents

The EU’s CBAM presents several opportunities for businesses and economies.

- Encouraging Cleaner Production Incentives: CBAM incentivizes companies to adopt cleaner production practices to reduce their carbon footprint and avoid additional costs associated with carbon-intensive imports.

- Promoting Sustainable Innovation: Businesses may invest in innovative technologies and processes to lower emissions, leading to advancements in sustainable practices and products that can differentiate them in the market.

- Boosting Competitiveness in the EU Market: Companies that proactively reduce their emissions gain a competitive edge in the EU market by avoiding the carbon price imposed on imports, enhancing their market position.

- Creating New Market Opportunities: The growing demand for low-carbon products and services may create new market opportunities for businesses specializing in sustainable solutions, fostering growth and innovation.

- Strengthening Trade Relationships and Partnerships: Countries and businesses that align with the EU’s climate goals may strengthen their trade relationships and partnerships with EU member states, enhancing their global trade networks.

Conclusion

The CBAM is a crucial part of the EU’s climate strategy, designed to prevent carbon leakage and promote sustainability. By imposing carbon costs on imported goods, CBAM encourages cleaner production methods worldwide and ensures fair competition for EU producers. It aligns with the EU’s climate goals of achieving neutrality by 2050 and reducing emissions by 55% by 2030. CBAM generates revenue for EU climate initiatives and promotes higher global environmental standards. However, its implementation poses challenges, such as ensuring compliance with international trade rules, managing economic impacts on trade partners, and addressing administrative complexities. Despite these challenges, CBAM represents a significant step toward a sustainable and climate-resilient future, benefiting the environment, EU industries, and global efforts to reduce carbon emissions.

Anticipation of similar CBAM mechanisms in other jurisdictions and potential carbon pricing adjustments in export-heavy nations further strengthens this trend. Ultimately, the CBAM encourages countries to adopt stronger climate policies to mitigate carbon leakage, maintain competitiveness, and potentially leverage credit mechanisms within the CBAM framework.

NeoImpact Guides Businesses Through CBAM Compliance with Expert Services

Navigate the intricacies of CBAM compliance with confidence by partnering with NeoImpact. We offer dedicated support and expertise to help your business adapt to this changing regulatory landscape. Our comprehensive services ensure a seamless transition to meet EU carbon regulations, helping your business thrive in a greener future.

CBAM READINESS ASSESSMENT

Analyzing a company’s products, value chains, and regions to determine their CBAM exposure and develop a tailored readiness plan.

COMPLIANCE SOLUTIONS

Developing strategies to meet CBAM requirements, including calculating embedded emissions, reporting, and ensuring smooth integration into business operations.

POLICY GUIDANCE AND RISK ASSESSMENT

Providing expert interpretation of CBAM policies, ongoing regulatory support, and strategic insights on future policy changes and carbon pricing risks

SUPPLY CHAIN OPTIMIZATION

Evaluating and optimizing supply chain carbon footprint, including Scope 3 decarbonization strategy and supply chain engagement plans.

DECARBONIZATION SOLUTIONS

Identifying and designing emission reduction strategies, including innovative technologies and practices

CAPACITY BUILDING AND TRAINING

Conducting workshops and training programs to enhance teams’ skills and ensure CBAM compliance.