ESG Reporting & Strategy Development for Private Markets

Board-level ESG strategies and audit-ready reporting, customized for today’s regulatory landscape and tomorrow’s investment goals.

Why ESG Reporting and Strategy Are Non-Negotiable ?

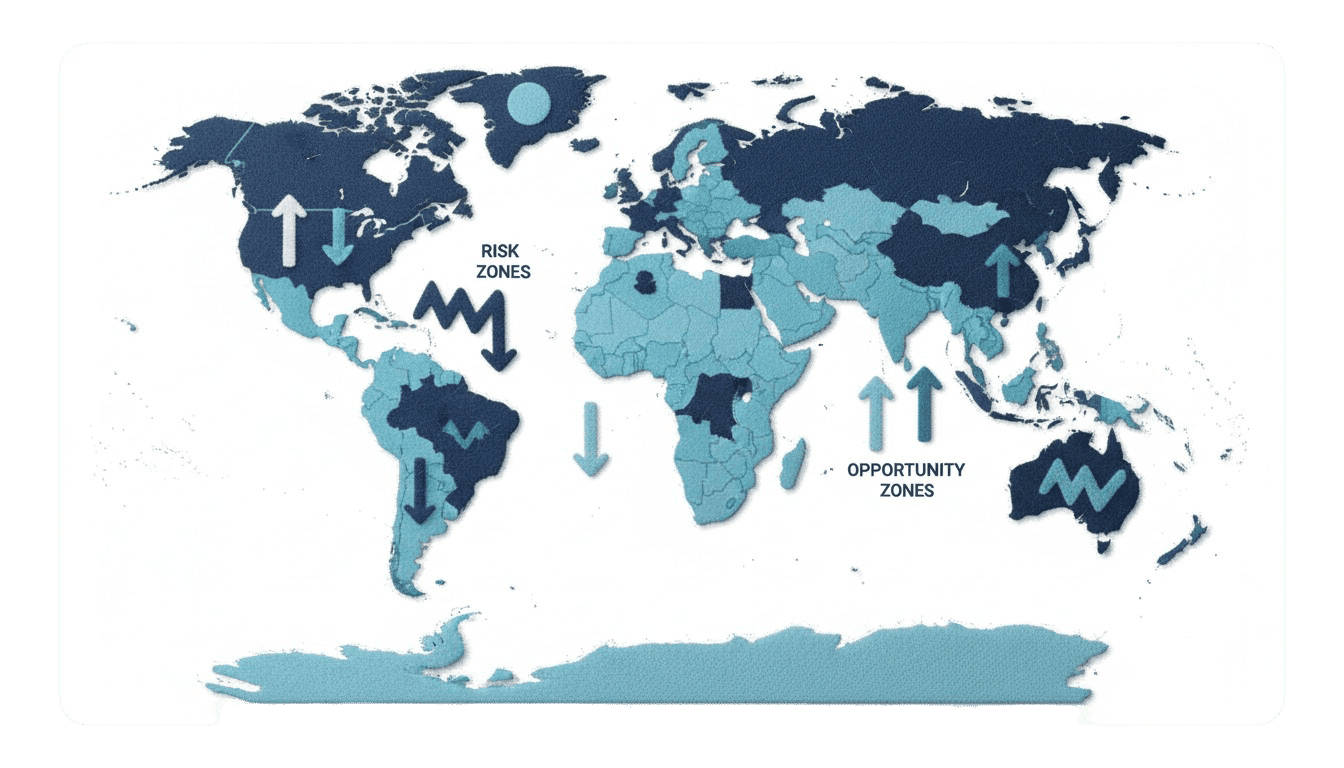

Today’s PE/VC funds, asset managers, and private market investors face rising regulatory demands and sharper scrutiny from limited partners, boards, and the public. Ad hoc disclosures and generic frameworks no longer pass muster—what’s needed are audit-ready, regionally nuanced ESG strategies and transparent, defensible reporting.

NeoImpact empowers you to not only comply, but to turn ESG into a catalyst for growth, risk management, and investor confidence.

Our Approach: Modular, Audit-Ready, and Investor-Focused

NeoImpact’s consulting methodology is modular and outcomes-driven. We partner with you from diagnostic to boardroom delivery, ensuring every ESG plan and disclosure stands up to investor, auditor, and regulatory scrutiny.

Comprehensive Diagnostic: Assess your current ESG maturity, data gaps, and compliance risks.

Strategy Development: Build a customized, regionally compliant ESG roadmap—aligned with global frameworks and your investment goals.

Reporting Execution: Design and deliver investor-grade ESG reports—transparent, traceable, and defensible.

Continuous Improvement: Provide ongoing monitoring, updates, and support to keep you ahead as standards evolve.