- Report Summary

- Table of Content

- Methodology

- Request for ESG Consultation

Report Overview

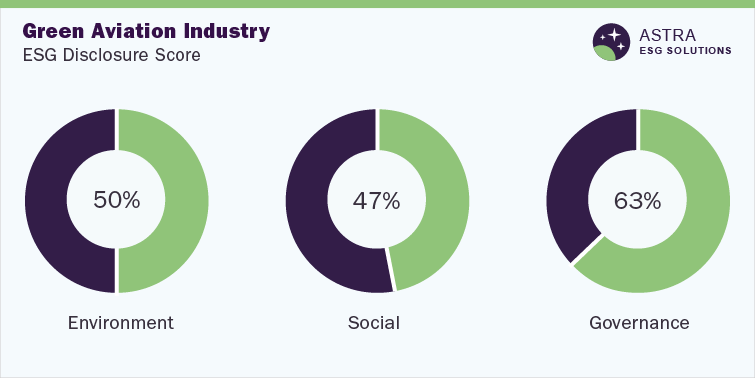

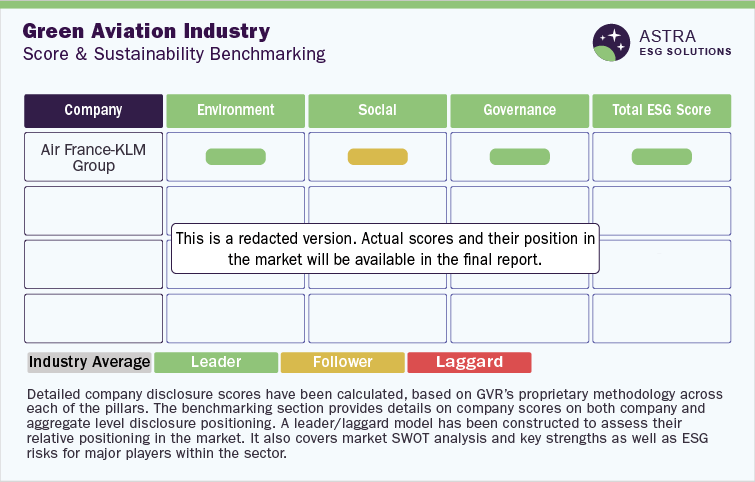

The average ESG disclosure score for green aviation stands between 50% and 60%. This conclusion is based on the analysis of more than 60 Environment, Social, and Governance (ESG) parameters within our ESG scoring framework. Alongside Air France-KLM Group, Deutsche Lufthansa, and International Consolidated Airlines Group S.A., seven other market leaders were part of our research.

This research identified that only one company, Air France-KLM Group, scored above the average industry score, while the nine other leading companies are required to improve their ESG transparency & reporting, as they scored well below the leader disclosure range. Our research found that the majority of the ESG disclosures have been made around the governance metric, with Air France-KLM Group being a leader in this sector when compared to other companies, such as Deutsche Lufthansa AG.

Environmental Insights

The need for sustainable or green aviation arises from the adverse environmental impacts, such as Greenhouse Gas (GHG) emissions, caused by the usage of conventional aviation fuel for air travel and commercial activity. Green aviation is a multidisciplinary field that gains its historical significance from discrete initiatives such as the deployment of alternative fuels, enhanced aircraft design and electric-hybrid aircraft that can improve overall operational efficiency and help in carbon offsetting.

In light of the increasing demand for commercial air activities such as air travel and freight transport, green aviation has garnered immense traction. To achieve sustainability in aviation, a range of approaches has been adopted using alternative fuels, including fuels sourced from plant material, waste material, natural gas, and different types of hydrocarbons.

Ethanol, for instance, has been used as a blend in the preparation of aviation fuel since the inception of the aviation industry, even though phased out as the main ingredient post World War II period. Another method to improve sustainability in aviation is through the evolution of aircraft design, where lightweight materials (such as alloys) have increased the operational efficiency of aircraft.

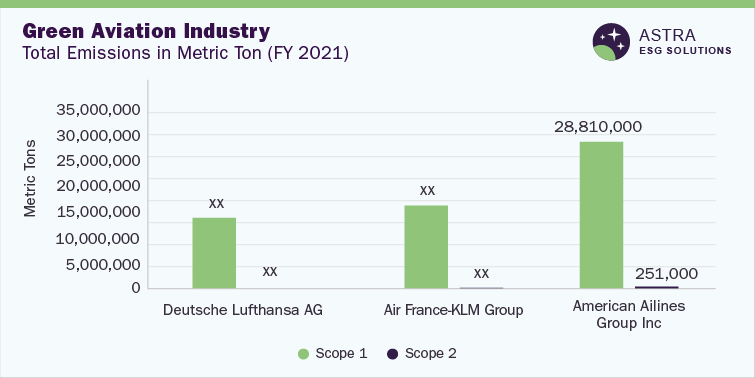

In terms of the environmental pillar, around 90% of the profiled companies in the green aviation industry have disclosed scope 1 and scope 2 emissions. While more than 80% of the companies profiled in the industry disclose the total energy consumed in their operations, only half of them disclose the renewable energy consumed in their operations. However, companies have incorporated energy conservation measures such as increasing the use of renewable energy in their operations and have set renewable energy goals to ensure sustainable consumption of energy resources.

The top three companies in the environmental pillar include Deutsche Lufthansa AG, Air France-KLM Group, and American Airlines Group Inc. Both leading companies have undertaken efforts like fleet modernization and have optimized their flight operations to reduce scope 1 and scope 2 emissions in their operations. Besides, they have invested in renewable energy certificates apart from relying on renewable energy supplies for their operations.

Our research identified that more than 50% of the companies profiled have board oversight of climate-related disclosures and that they are compliant with the Paris Agreement. Two of the top three companies in environmental benchmarking have specific committees supervised by the board to oversee climate change initiatives. In addition, 50% of the companies profiled in our research have waste-management targets in place. Among the top three companies, Deutsche Lufthansa AG and Air France-KLM Group have waste management targets in place, which focus on reducing non-recyclable waste in their operations.

In terms of Environmental Management Certification, according to our research, around 20% of the profiled companies have reported having an ISO 14001 certification, which shows a lack of effective utilization of resources across the majority of the companies in our research. Among the top three firms, only Air France-KLM Group had maintained its ISO 14001 Environmental Management Certification, which it was accredited in 2008.

With respect to environmental benchmarking, the following chart compares the scope 1 and scope 2 emissions along with the emission intensity of the top three companies in this category:-

Social Insights

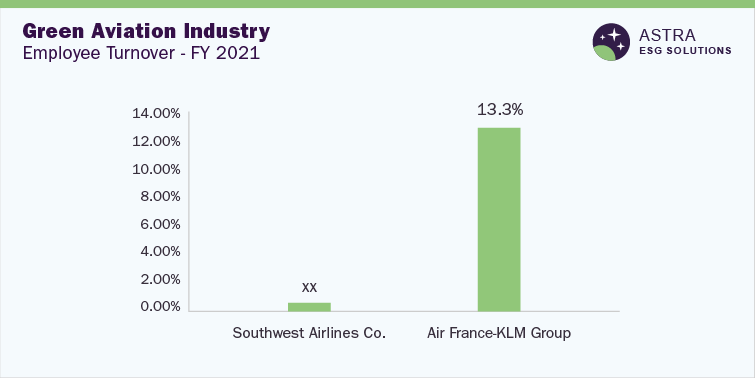

The social component of ESG deals with the improvement of the supply chain of the companies, the employee retention and turnover rate, and health and safety metrics. Around 70% of the companies in the green aviation market have disclosed employee turnover rates and the same number of companies offer healthcare benefits to their employees. Measuring employee turnover enables an organization to understand its hiring practices better and fill the gaps that are unknown to the organization.

In terms of supply chain code of conduct, 70% of the profiled companies in the green aviation industry have institutionalized a supply chain code of conduct, with all of the top three companies in the social pillar having a supplier code of conduct incorporating human rights standards and principles.

In terms of Diversity & Inclusion (D&I), around 80% of the profiled companies in the green aviation industry have publicly disclosed diversity programs and have set targets to improve diversity in the workplace.

A diverse workforce ensures that the industry can better understand and meet the needs of a wide range of customers and stakeholders. In this regard, profiled companies, such as International Consolidated Airlines Group S.A. and ANA Holding Inc., have diversity and inclusion policies and programs in place that not only serve diversified customers but also help attract a wide range of talent. In addition, a commitment to diversity and inclusion helps create an inclusive workplace culture where employees feel valued and respected. This, in turn, enhances employee morale, satisfaction, and retention.

In terms of safety, only around 20% of the companies of the industry reported to have ISO 45001 safety standards, posing a challenge to the industry. The green aviation industry involves various high-risk activities, including manufacturing, maintenance, and operation of aircraft. Implementing ISO 45001 ensures that health and safety risks are identified, assessed, and controlled, thereby reducing the likelihood of accidents and incidents. This is crucial for protecting the well-being of employees in the green aviation sector. According to our research, among the top three companies (Deutsche Lufthansa AG, Southwest Airlines Co., and Air France-KLM Group) in the social pillar, only one company is accredited to the ISO 45001 Health and Safety Certification.

With respect to social benchmarking, the charts below compare employee turnover rates and average training hours across two of the top three companies in this category:-

Governance Insights

Investors and other stakeholders expect board diversity, transparency, shareholders’ rights, anti-competitive practices and corporate behavior to bring a paradigm shift in the green aviation industry. A wide range of metrics in the governance sphere, such as code of business conduct, risk and crisis management, and supply chain management, are critical for evaluation in the green aviation sector.

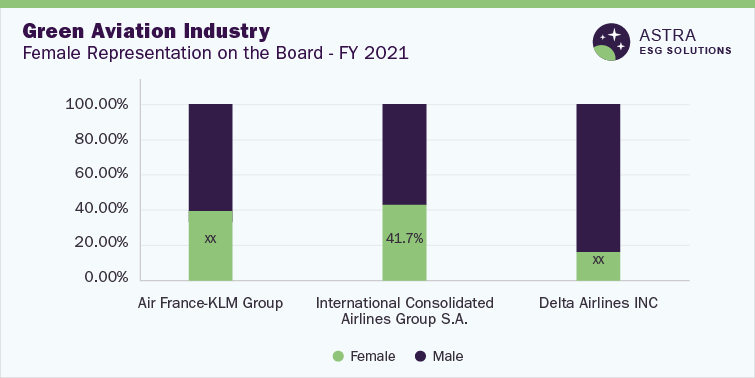

The analysis of board diversity between 2019 and 2021 indicated that 80% of the profiled companies have female boards of directors. The top three companies include Air France-KLM Group and International Consolidated Airlines Group S.A. (IAG). Among the top three companies, IAG reported the highest number of females and percentage of women on its board. Various diversity initiatives undertaken by IAG include having a diversity panel in place, which assists with the inclusion and diversity initiatives. In addition, the company has also set a target to increase the percentage of women on its board.

Around 80% of the profiled companies reported to have a code of conduct that applies worldwide to their affiliates and subsidiaries. A code of conduct establishes an ethical framework that outlines the principles and values that the company and its employees should uphold. For companies in the green aviation industry, this framework ensures that ethical considerations are integrated into decision-making processes, promoting responsible and sustainable practices. However, despite the majority of the companies having a code of conduct, they lack audits for corruption in the supply chain, which is critical for the green aviation industry since companies often have complex supply chains.

A code of conduct can be extended to suppliers, setting expectations for responsible business practices that ensure accountability and transparency while also ensuring the company’s commitment to sustainability is maintained across all aspects of its operations.

Around 90% of the profiled companies have reported undertaking cybersecurity programs across the profiled years (2019 to 2021) and all the top three companies of the governance pillar have cybersecurity programs in place. Air France-KLM Group limits security risk across its organization through a cybercrime program that includes measures for preventing and detecting cybercrime, including cyber threat surveillance, testing for the security of information systems, and spotting online intrusions. Moreover, additional preventive measures such as training and guidelines are also included to mitigate the security risks.

With respect to the governance benchmarking, the below charts compare the percentage of women on board and the percentage of independent directors on board across the three companies in this category:-

Country-level Insights

At the international level, the U.S., Sweden, and the U.K., among a few others, are considered leading countries with respect to the number of Sustainable Aviation Fuel airports, according to our research. The U.S. is regarded as the champion in this green aviation market, with the highest number of SAF airports. In August 2022, Hillsboro Aviation Services, which offers airplane and helicopter services, introduced SAF in its headquarters in Oregon. The company collaborated with Neste and Avfuel Corporation, which are producers of SAF, to obtain 8,000 gallons of SAF.

Sweden is the second largest SAF airport, with more than 10 SAF airports in the country. The country has collaborated with Air BP and Neste, who are major fuel providers, and Paper Province, Statoil Fuel & Retail Aviation, and a few other firms to produce and use biofuel for commercial and business aviation.

The UK accounts for 10% of the SAF airports in the world and at the country level, London Luton Airport utilizes SAF for commercial operations provided by Neste and Signature Flight Support. In essence, London Luton Airport received the ceremonial gallon of 1000 gallons of SAF pumped bySignature Flight Support and Nestein the year 2020.

Chapter 1. Introduction

1.1 Top Countries with the Highest Sustainable Aviation Fuel Imports

1.2 New Technology Innovations in Green Aviation

1.3 Investments Across the Top Countries in Green Aviation

1.4 Patents, Mergers, Deals and Acquisitions.

Chapter 2. Industry Benchmarking

2.1 Overall Industry Disclosure Score

2.2 Disclosure Score Benchmarking

2.3 SWOT Analysis

Chapter 3. Company Profiles

3.1 Air France-KLM Group

3.2 Deutsche Lufthansa AG

3.3 International Consolidated Airlines Group S.A.

3.4 Delta Air Lines, Inc.

3.5 Southwest Airlines Co.

3.6 American Airlines, Inc.

3.7 United Airlines Holdings Inc.

3.8 ANA HOLDINGS, INC.

3.9 China Southern Airlines Company Limited

3.10 China Eastern Airlines Corporation Limited

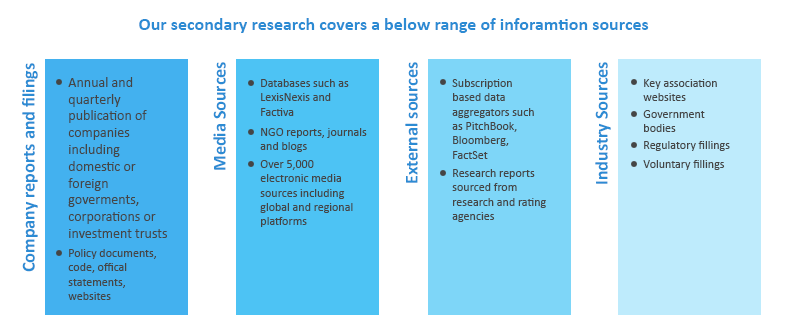

Research methodology

Grand View Research (GVR) employs a holistic and robust research methodology focused on delivering precision. Our ESG key issues are selected following a thorough materiality analysis run by our taxonomy committee. We examine leading business journals relevant to the industry sector and where applicable references are made to a range of sources including regulatory agencies, trade associations, company filings, white papers, and analyst reports during the due diligence on data aggregation. In addition, a recurring theme that remains central to all our research reports remains data triangulation which aims to dive into the market from thematic context, regulation, and industry benchmarking, including SWOT analysis.

Eligibility Criteria and Company Selection

Each public company is curated by our senior researchers following a comprehensive study of their business involvement around a specific theme. The involvement extends to subsidiaries based on at least 50% holding by the parent company. Following this, we analyze fundamental financial indicators, including revenue and market capitalization to ensure a diverse set of companies that fairly represent the sector are included. Additionally, GVR researchers ensure the disclosure level of each company across the material ESG key issues.

Scoring Methodology

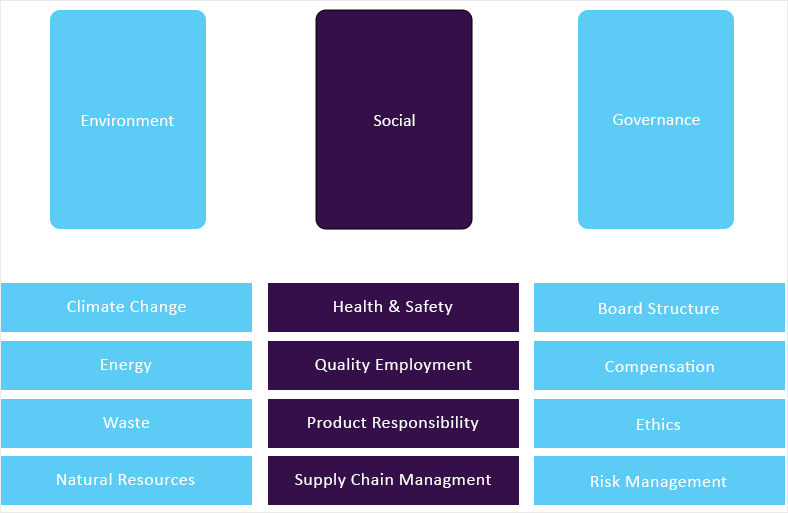

Each ESG metric is assigned a specific weight based on its relevance across sectors. Below are the aggregated weights across pillars, which are derived from each metric.

| Environment | Social | Governance |

| 40% | 30% | 30% |

GVR’s proprietary ESG score is calculated using a weighted average method at:

• Key issues level

• Pillar level

• Company level and,

• Theme level

Data Mining

Data is obtained and collated from diverse source points. The data collected is continuously cleansed to ensure that only validated and verifiable sources are analyzed. In addition, data is also mined from a large number of in-house syndicated research reports inventory as well as through paid databases and premium content. During this research report, we conducted multiple primary interviews across the globe supported by our Primary Research Panels through the delivery of a mix of paid and unpaid interviews. We also send and receive responses from a wide section of industry participants through a carefully crafted and comprehensive survey questionnaire. We triangulate these data into quant models and generate qualitative insights. Evolving industry dynamics that shape drivers, restraints, and pricing are also gathered. As a result, the published content includes proprietary data and meaningful insights.

Fundamental ESG data:

GVR’s ESG taxonomy committee maintains the framework and ensures it is updated quarterly considering market updates and relevance. Framework includes 65+ fundamental ESG metrics that are identified following a thorough materiality assessment. Below is GVR’s ESG Level-I framework:

Alternative ESG data:

GVR also analyzes macro-economic factors that impact or drive the growth of respective sectors. This includes

• Deep dive analysis of policy and regulatory landscape that has potential towards shaping the future of businesses

• Innovation quotient of a sector to gauge prospective evolution of a theme and related opportunities

• Investment scenario, including mergers & acquisition, funding and other deals to assess the investment appetite for a particular theme

• Other market activities, including market size, growth forecasts among others.

Information sources