Compliance, ESG Challenges & Framework, ESG Trends

- Report Summary

- Methodology

- Request for ESG Consultation

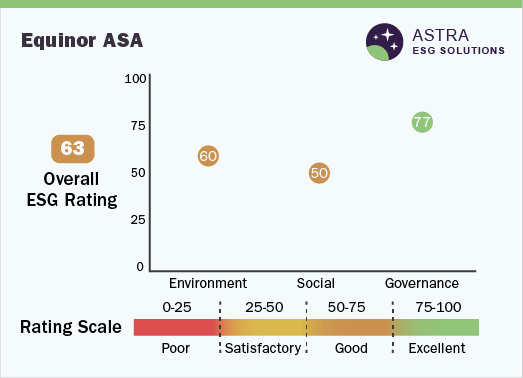

Environment, Social and Governance (ESG) at Equinor ASA

The policies that impact the environment, social, governance, which are made by the companies, involving the consumers and the governments, is shaping the current trend in investments in an unprecedented manner.

Being a key leader in the energy industry, Equinor, is motivated by the idea of sustainability and has built itself around it in the aspects of Environment, Social, and Governance, focusing on the three pillars and striving to promote eco-friendly sources of energy among its customers with environmentally friendly methods of operations. In regard to this, Equinor had made policies that define its core ethical values of governance, striving to make a positive impact in all three areas of ESG and also focused on closely aligning with the United Nations’ Sustainable Development Goals (UN SDGs).

The exploitation of natural resources and the need for sustainable and renewable energy sources, has led Equinor to adapt to sustainable technologies and policies.

ESG Trends

Equinor ASA is trying to create a positive impact in the environment, social and governance spheres by making effective policies and strategies. Being one of the key companies in the energy industry, it has created an impact in terms of ESG.

The company has aimed to create a stand in the energy market, by adopting low carbon emissions technologies and achieving a net zero target by 2050. In the process, the company has reduced Scope 1 and Scope 2 emissions from the energy generation processes significantly and aimed to reduce the current emissions by 40% by 2035. The company has made a climate change policy based on the Paris Agreement and the policy focuses on addressing the risks and challenges pertaining to climate change.

Equinor ASA has recorded a Total Recordable Injury Frequency of 2.4% and with a Serious Injury Frequency of 0.4% in 2021. The company has made policy frameworks as to promote safety amongst the employees, where it uses management systems to track and assess the risks, helping in preventing major accidents at work, and promoting the safety of the employees.

Equinor ASA has focused on the social challenges in terms of ESG, such as gender diversity and inclusion and pay disparity amongst the genders. The workforce in the company as of 2021 was reported to be made up of 33% of the female workforce and the remaining 67% being male workforce which is still far from gender parity.

Furthermore, Equinor ASA has incorporated policies regarding the code of ethics, which mandates the employees of the corporation to engage and adhere to the ethical code. The company has mandated all the employees to complete training in ethics and compliance and mandates all the employees to go through an ethics refresher training program annually, reflecting the core ethics of the company.

The code also mandates the members of the supplier chain to adhere to the policy to reduce the ethical challenge. The policy also focuses on anti-bribery and corruption, striving to eradicate and stick to the ethical policy strictly, thereby promoting the UNSDG goals of institutions for peace and justice (SDG16).

Future of the Equinor ASA

Equinor ASA has generated a revenue of USD 90.9 billion in 2021. Being one of the key leaders of the energy industry, Equinor has made initiatives and policies that create a positive impact on the environment and society in parallel, and these policies reflect the core values of Equinor ASA.

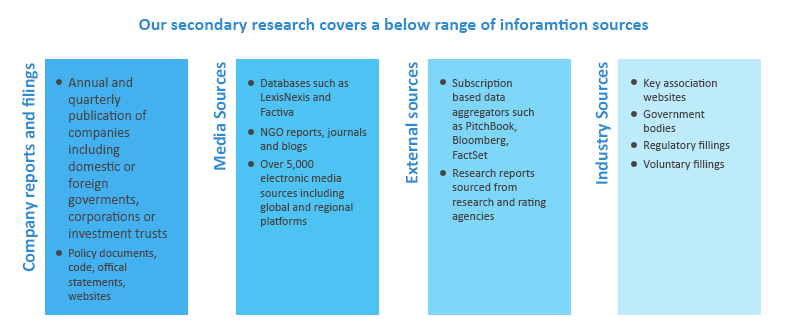

Research methodology

Grand View Research (GVR) employs a holistic and robust research methodology focused on delivering precision. Our ESG key issues are selected following a thorough materiality analysis run by our taxonomy committee. We examine leading business journals relevant to the industry sector and where applicable references are made to a range of sources including regulatory agencies, trade associations, company filings, white papers, and analyst reports during the due diligence on data aggregation. In addition, a recurring theme that remains central to all our research reports remains data triangulation which aims to dive into the market from thematic context, regulation, and industry benchmarking, including SWOT analysis.

Eligibility Criteria and Company Selection

Each public company is curated by our senior researchers following a comprehensive study of their business involvement around a specific theme. The involvement extends to subsidiaries based on at least 50% holding by the parent company. Following this, we analyze fundamental financial indicators, including revenue and market capitalization to ensure a diverse set of companies that fairly represent the sector are included. Additionally, GVR researchers ensure the disclosure level of each company across the material ESG key issues.

Scoring Methodology

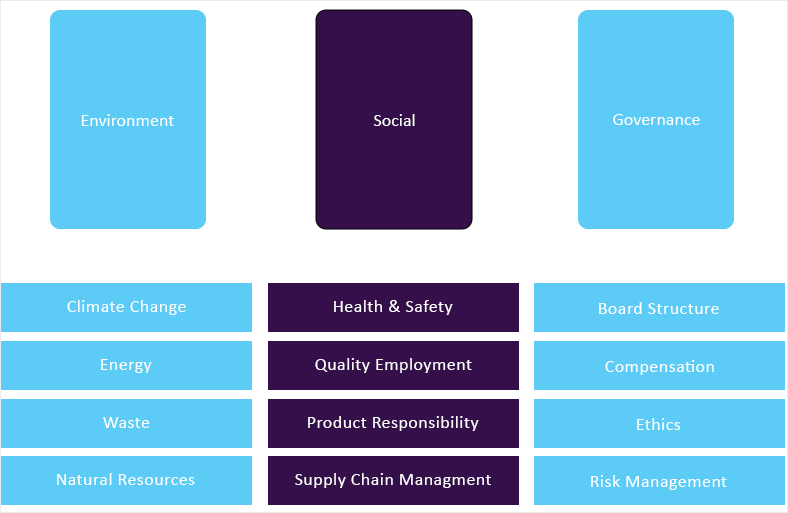

Each ESG metric is assigned a specific weight based on its relevance across sectors. Below are the aggregated weights across pillars, which are derived from each metric.

| Environment | Social | Governance |

| 40% | 30% | 30% |

GVR’s proprietary ESG score is calculated using a weighted average method at:

• Key issues level

• Pillar level

• Company level and,

• Theme level

Data Mining

Data is obtained and collated from diverse source points. The data collected is continuously cleansed to ensure that only validated and verifiable sources are analyzed. In addition, data is also mined from a large number of in-house syndicated research reports inventory as well as through paid databases and premium content. During this research report, we conducted multiple primary interviews across the globe supported by our Primary Research Panels through the delivery of a mix of paid and unpaid interviews. We also send and receive responses from a wide section of industry participants through a carefully crafted and comprehensive survey questionnaire. We triangulate these data into quant models and generate qualitative insights. Evolving industry dynamics that shape drivers, restraints, and pricing are also gathered. As a result, the published content includes proprietary data and meaningful insights.

Fundamental ESG data:

GVR’s ESG taxonomy committee maintains the framework and ensures it is updated quarterly considering market updates and relevance. Framework includes 65+ fundamental ESG metrics that are identified following a thorough materiality assessment. Below is GVR’s ESG Level-I framework:

Alternative ESG data:

GVR also analyzes macro-economic factors that impact or drive the growth of respective sectors. This includes

• Deep dive analysis of policy and regulatory landscape that has potential towards shaping the future of businesses

• Innovation quotient of a sector to gauge prospective evolution of a theme and related opportunities

• Investment scenario, including mergers & acquisition, funding and other deals to assess the investment appetite for a particular theme

• Other market activities, including market size, growth forecasts among others.

Information sources