Powering Sustainability & ESG Intelligence for Private Markets

A Single Platform. Five ESG Intelligence Engines.

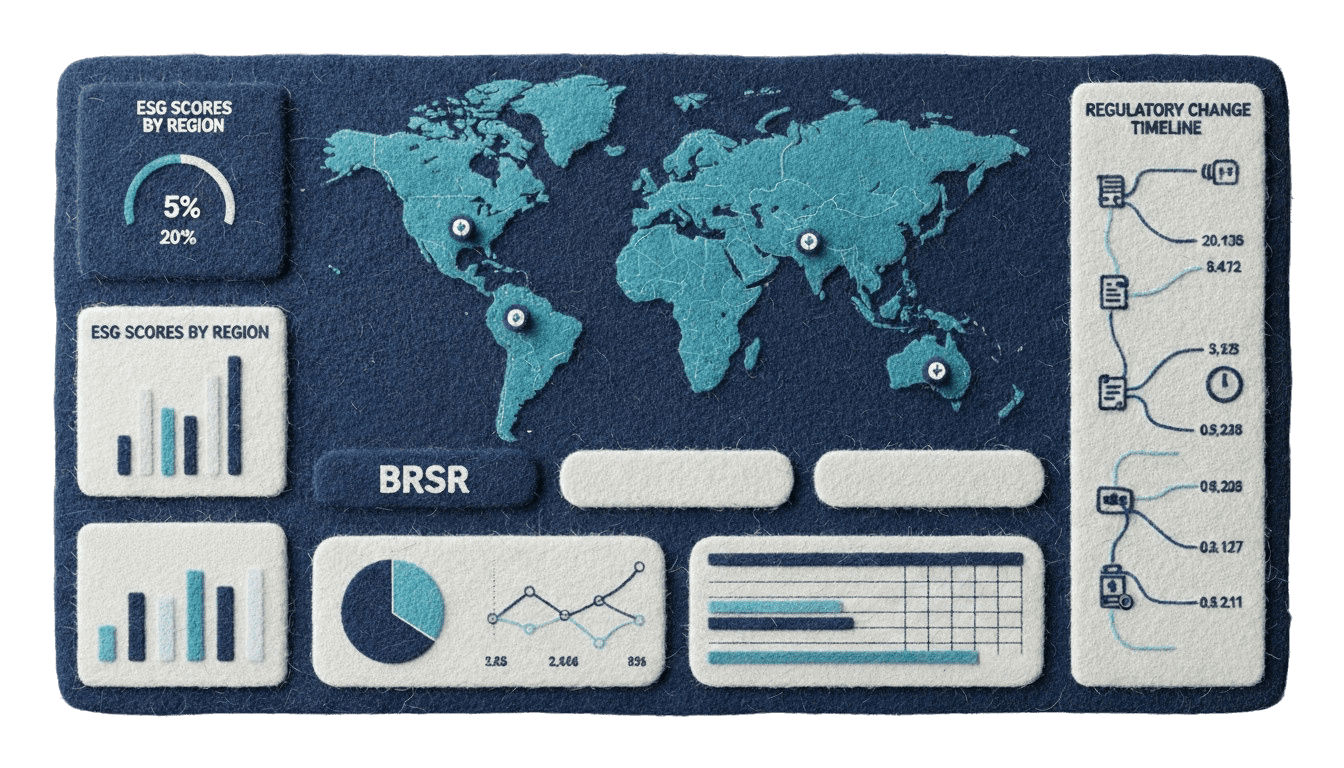

From private company insights to global regulatory shifts—NeoImpact delivers actionable ESG intelligence across every dimension. The end-to-end platform for real-time ESG due diligence, monitoring, and compliance in global private markets.

NeoImpact Sustainability & ESG Intelligence Purpose Built for Private Markets

Framework‑Aware

Ready for BRSR, SFDR, CSRD, ISSB, EDCI, and more

Regional + Global

Deep local expertise across India, Europe, North America, APAC

Integrated, Not Siloed

All your ESG intelligence in one place with cross-stream linkage

Actionable Alerts

Not just data, but contextual insights, signals, and recommendations

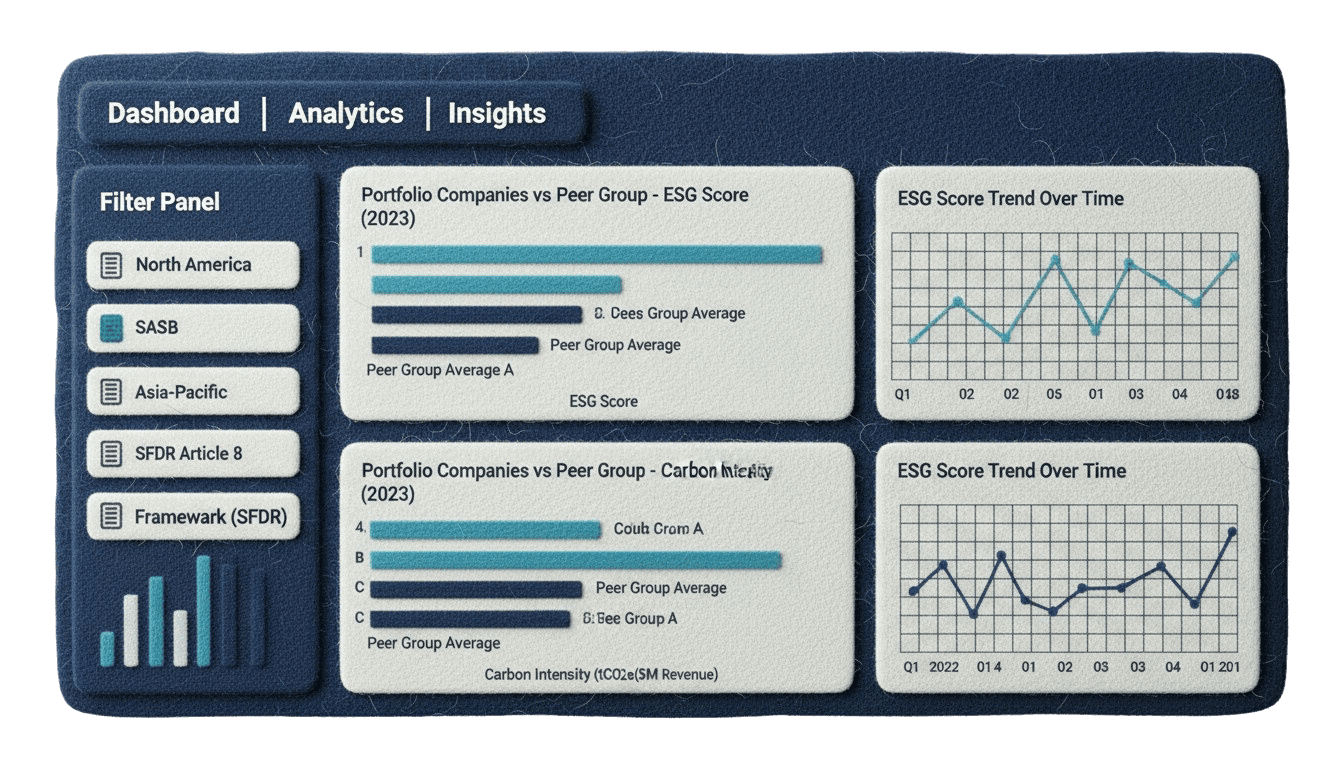

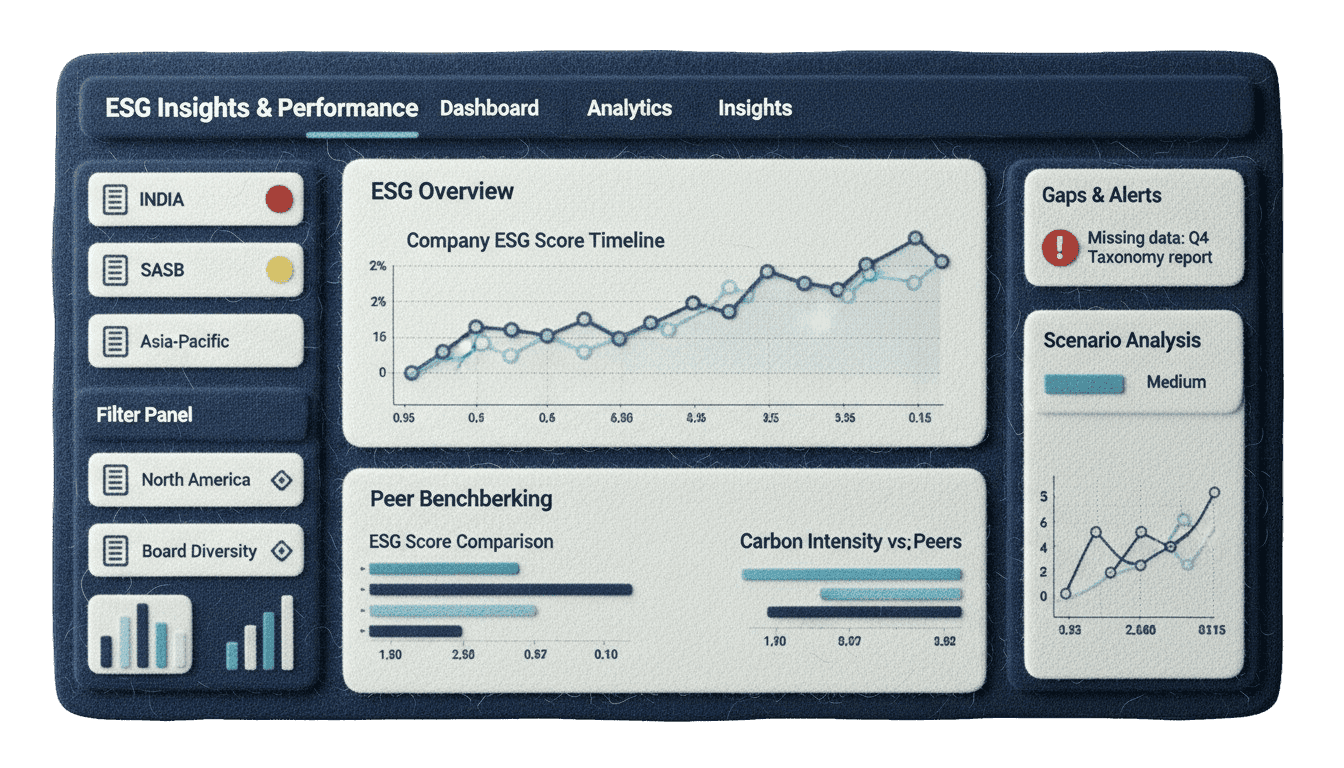

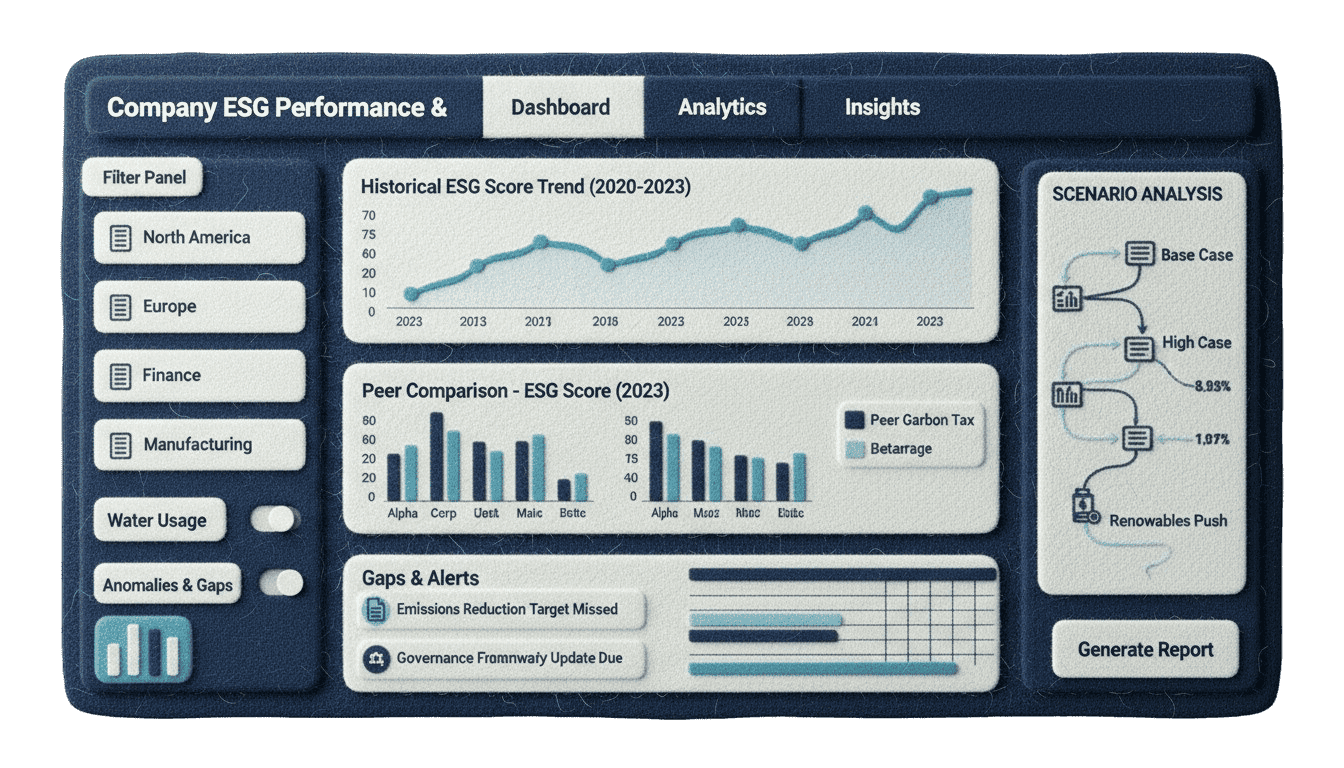

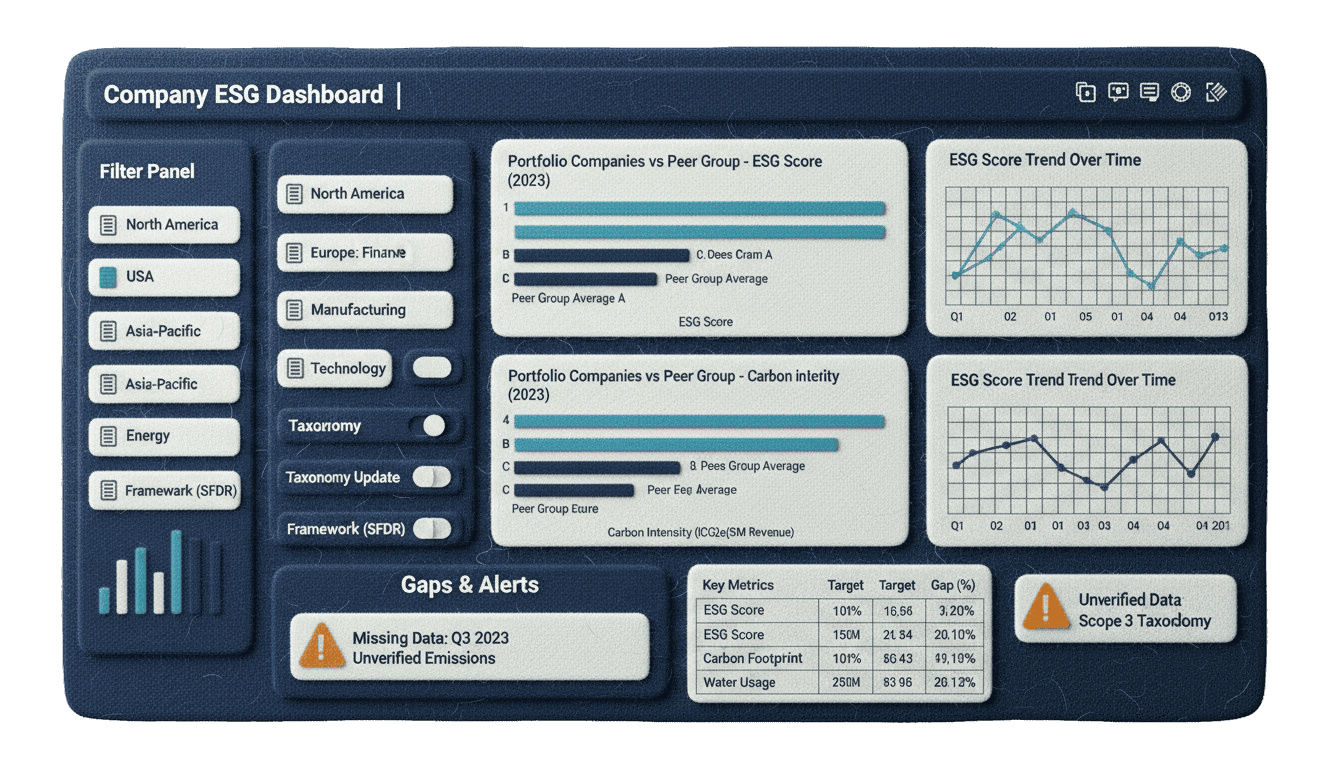

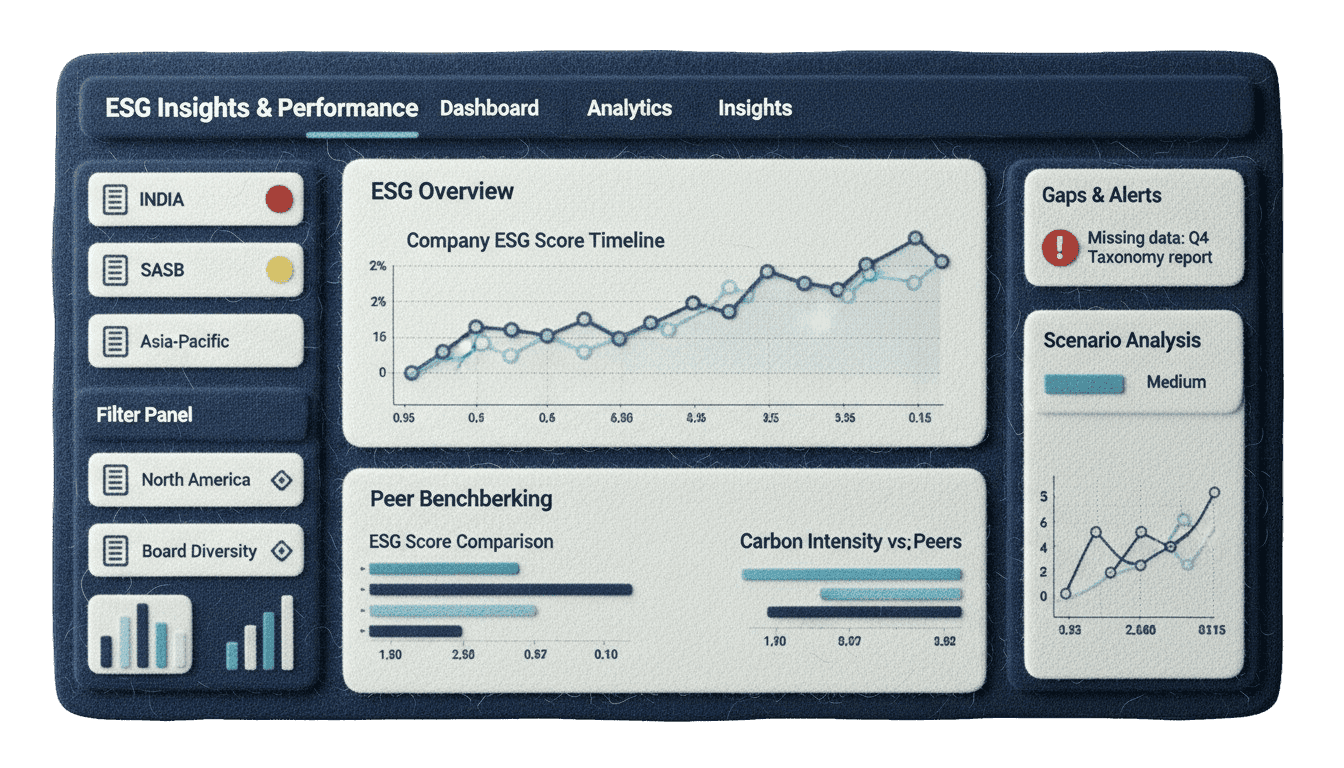

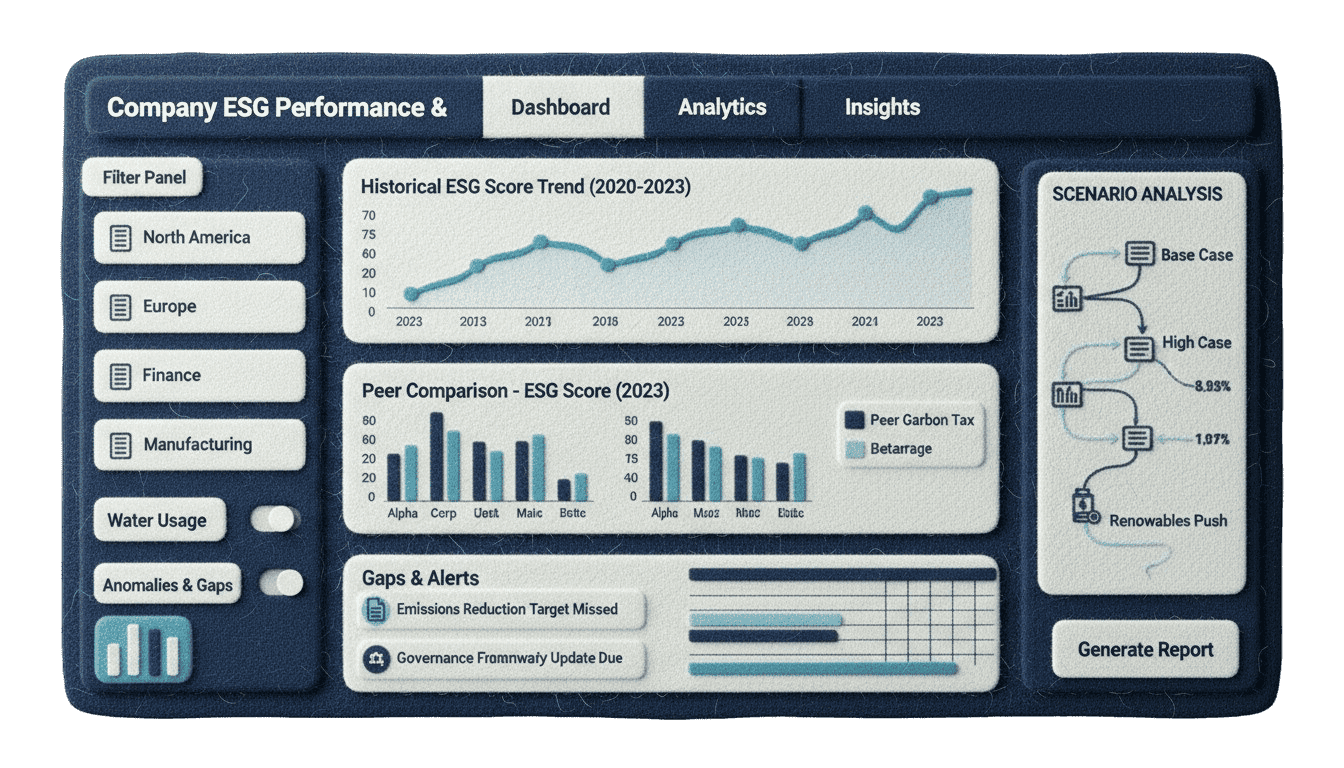

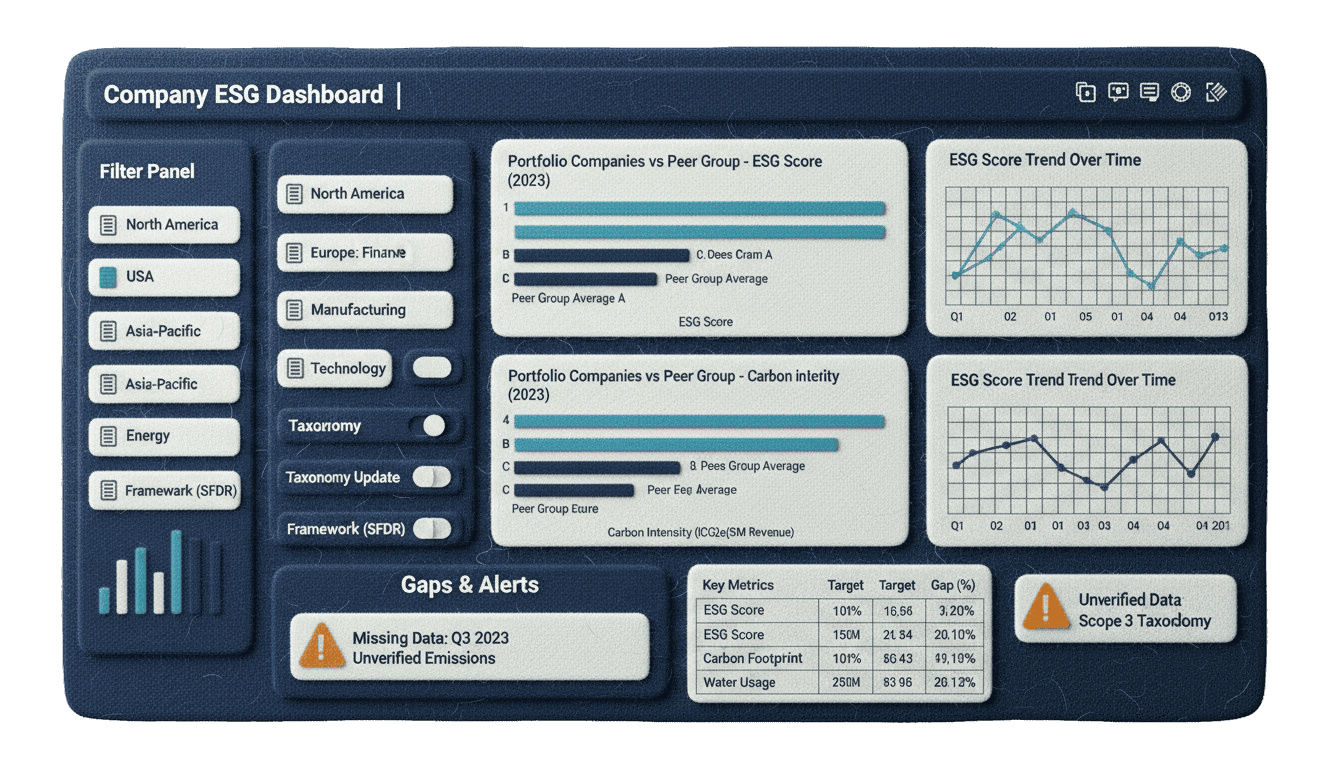

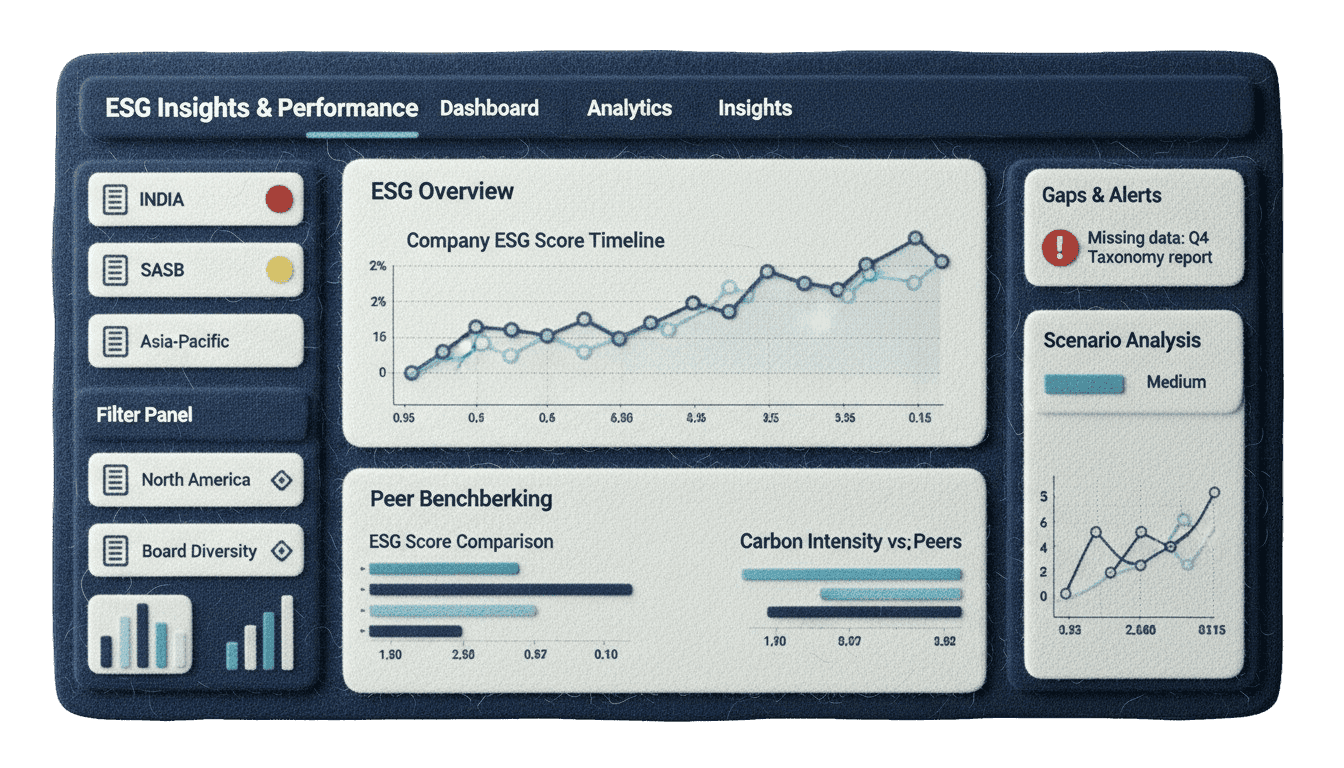

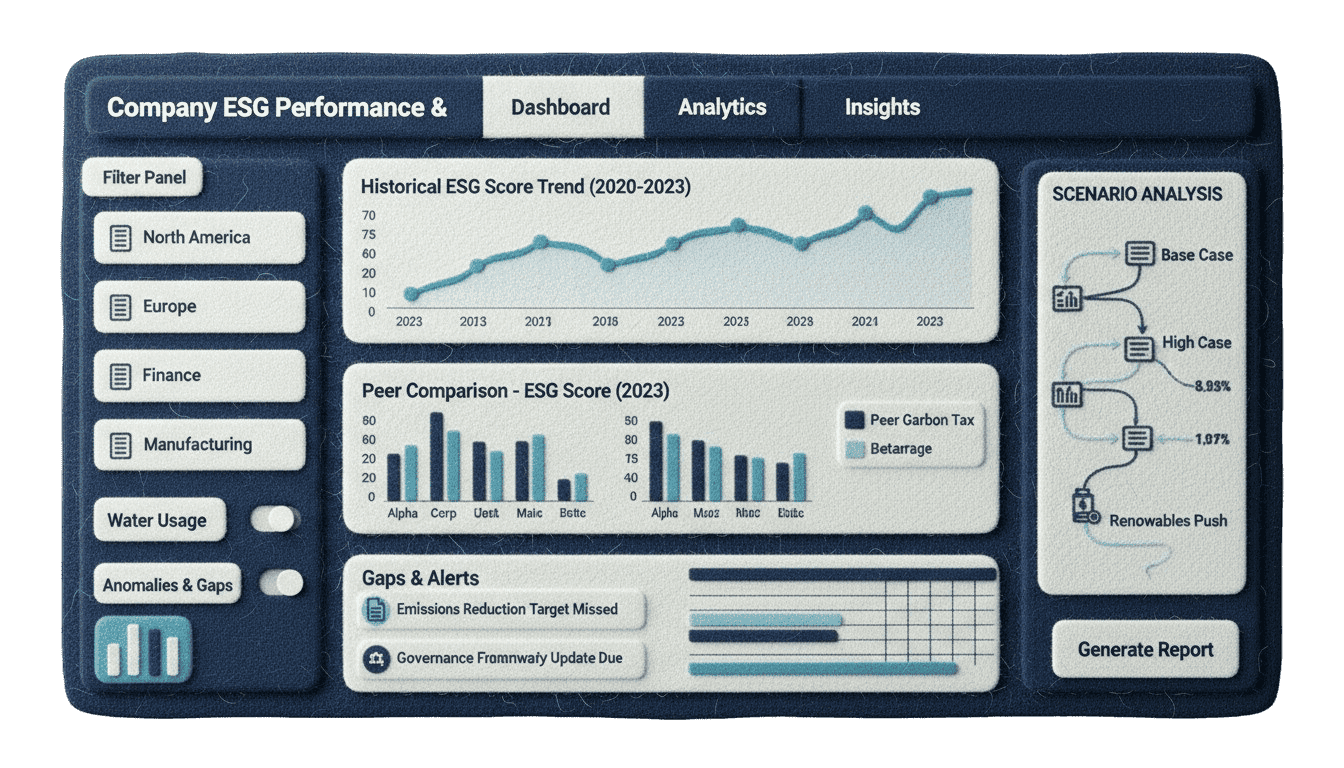

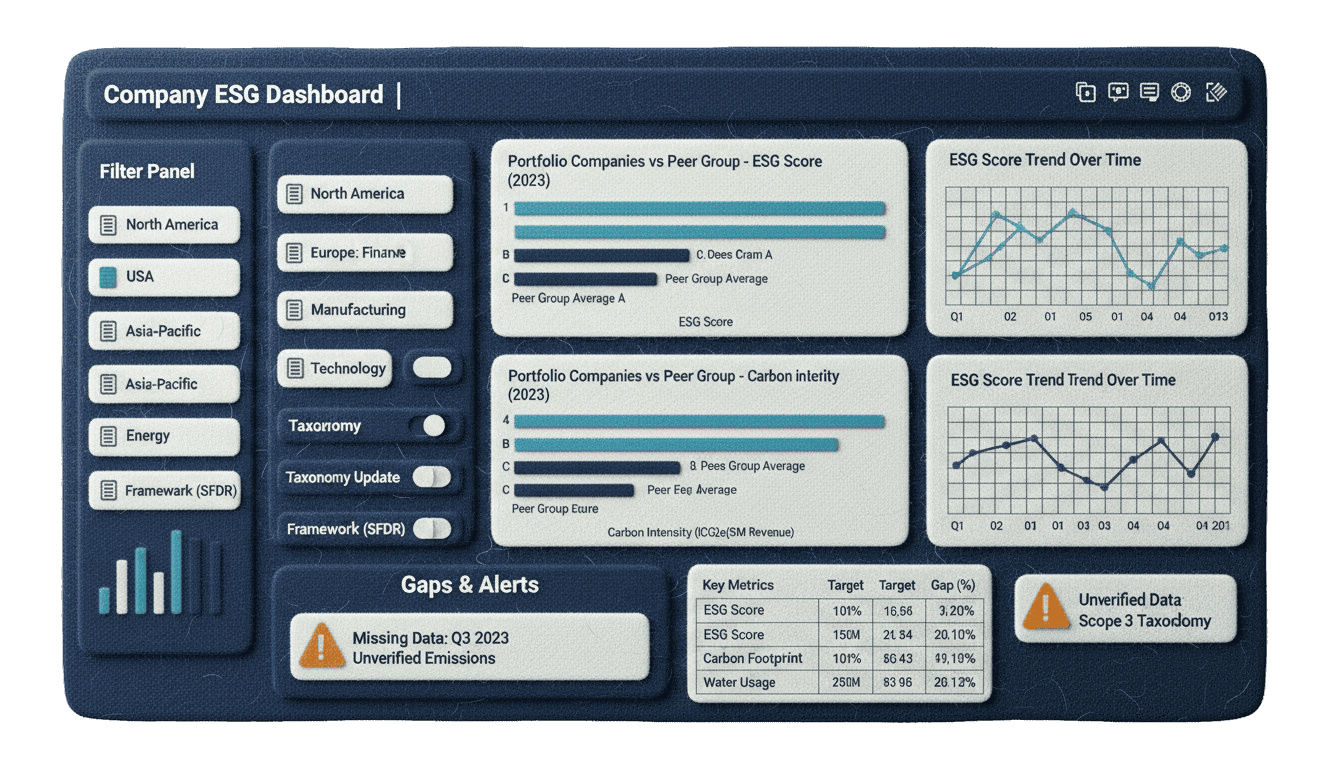

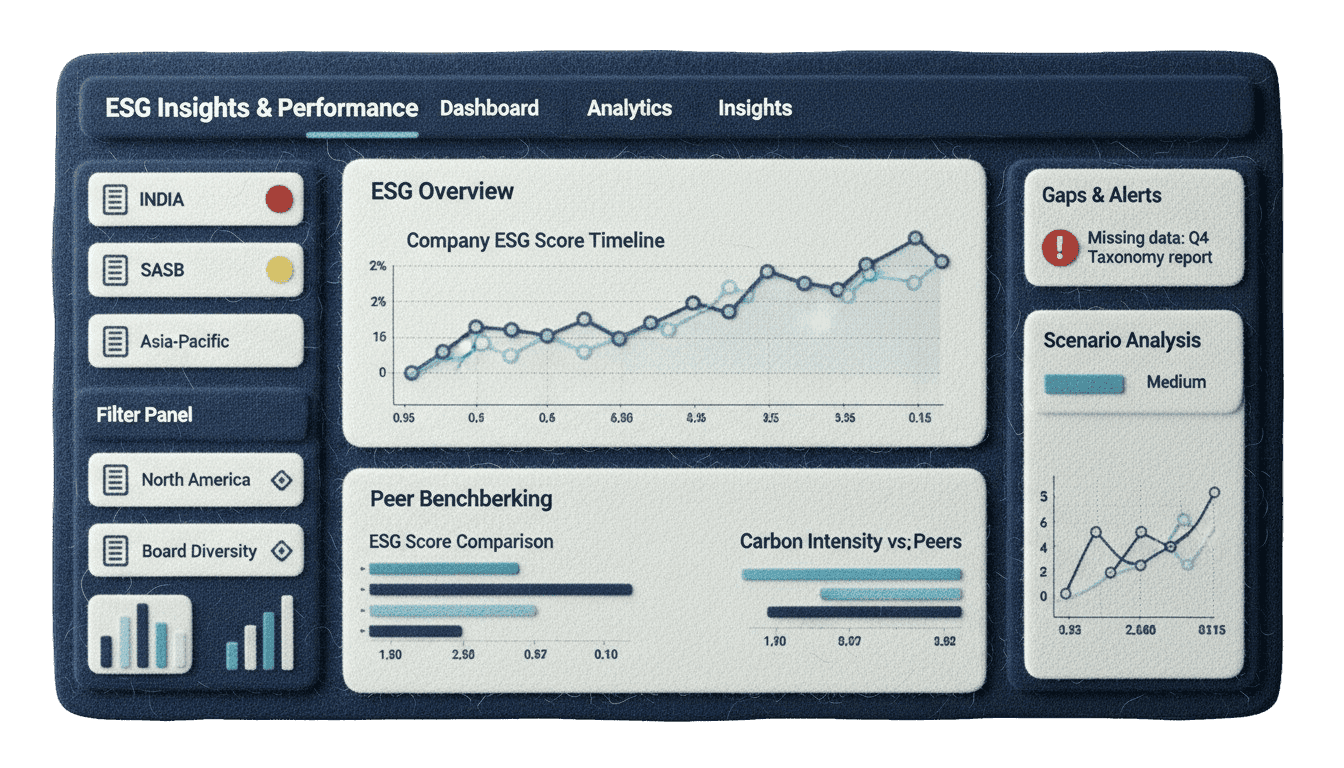

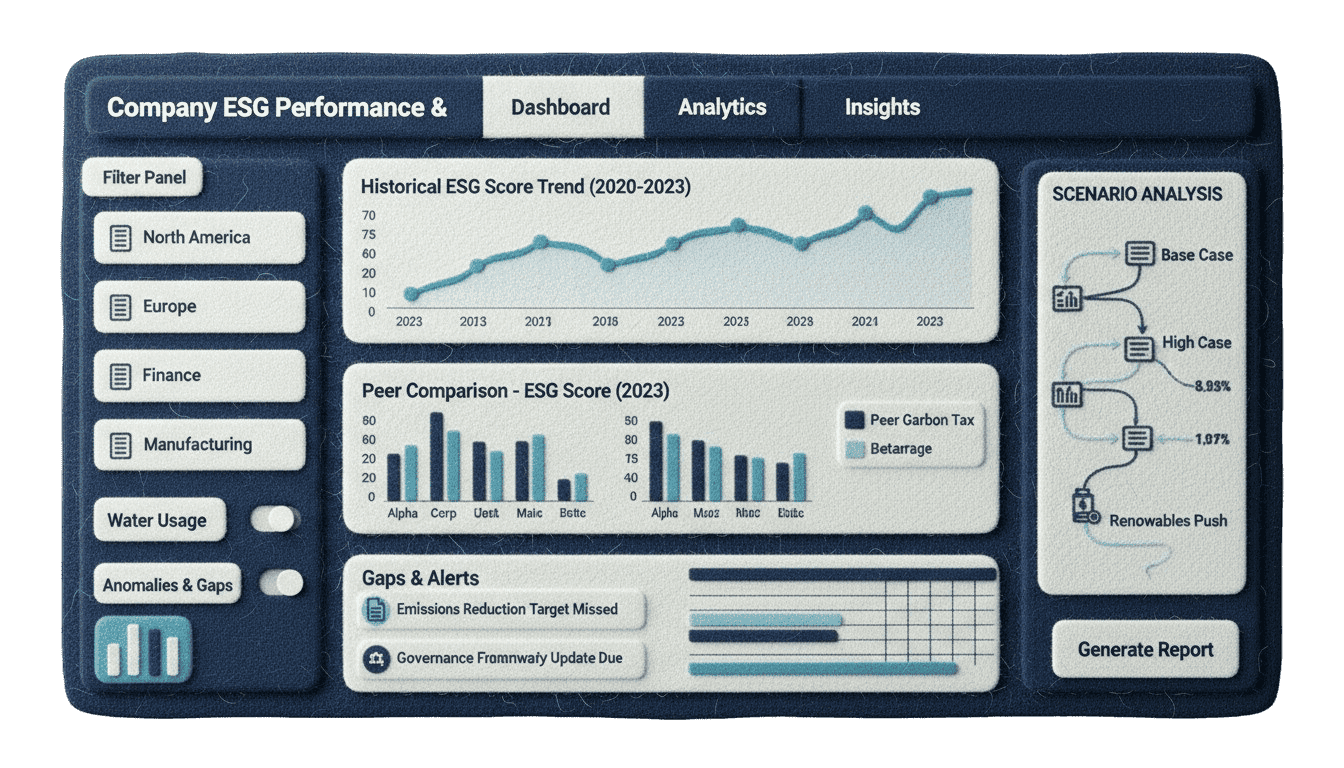

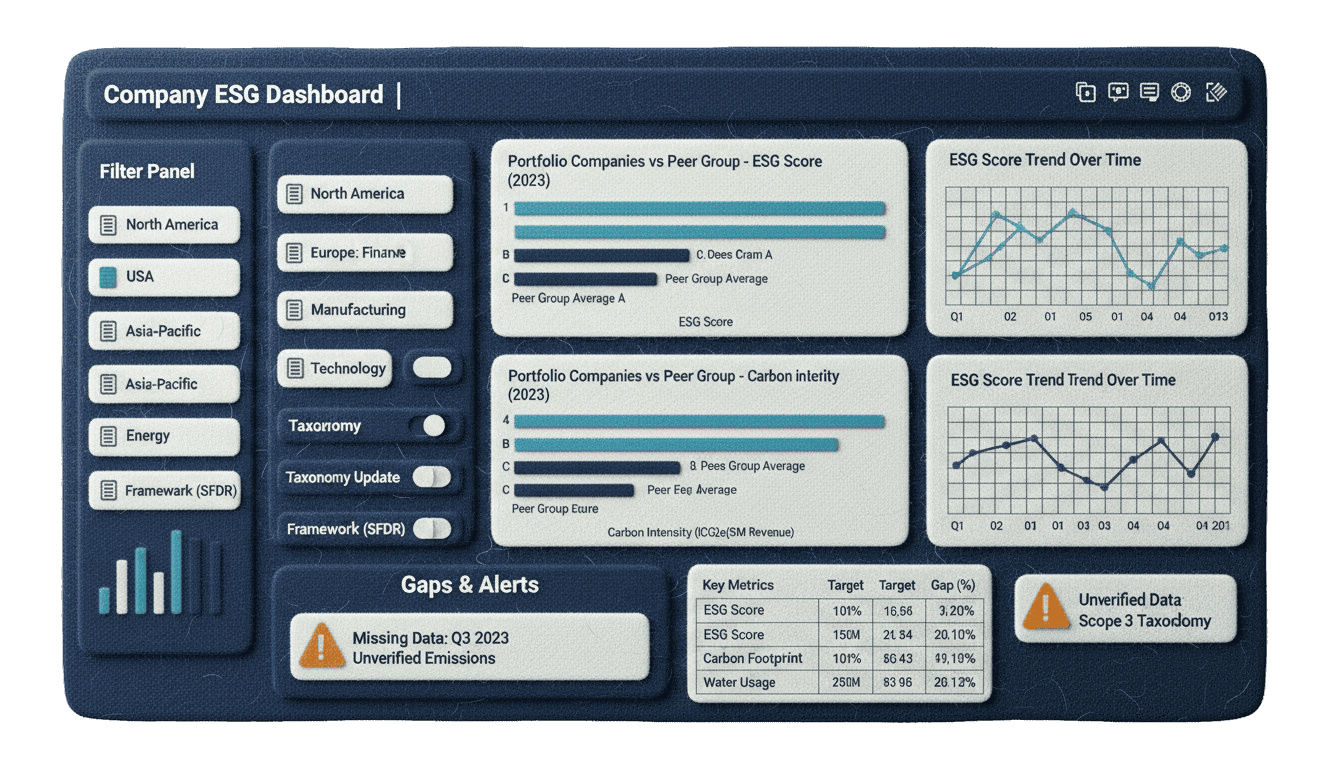

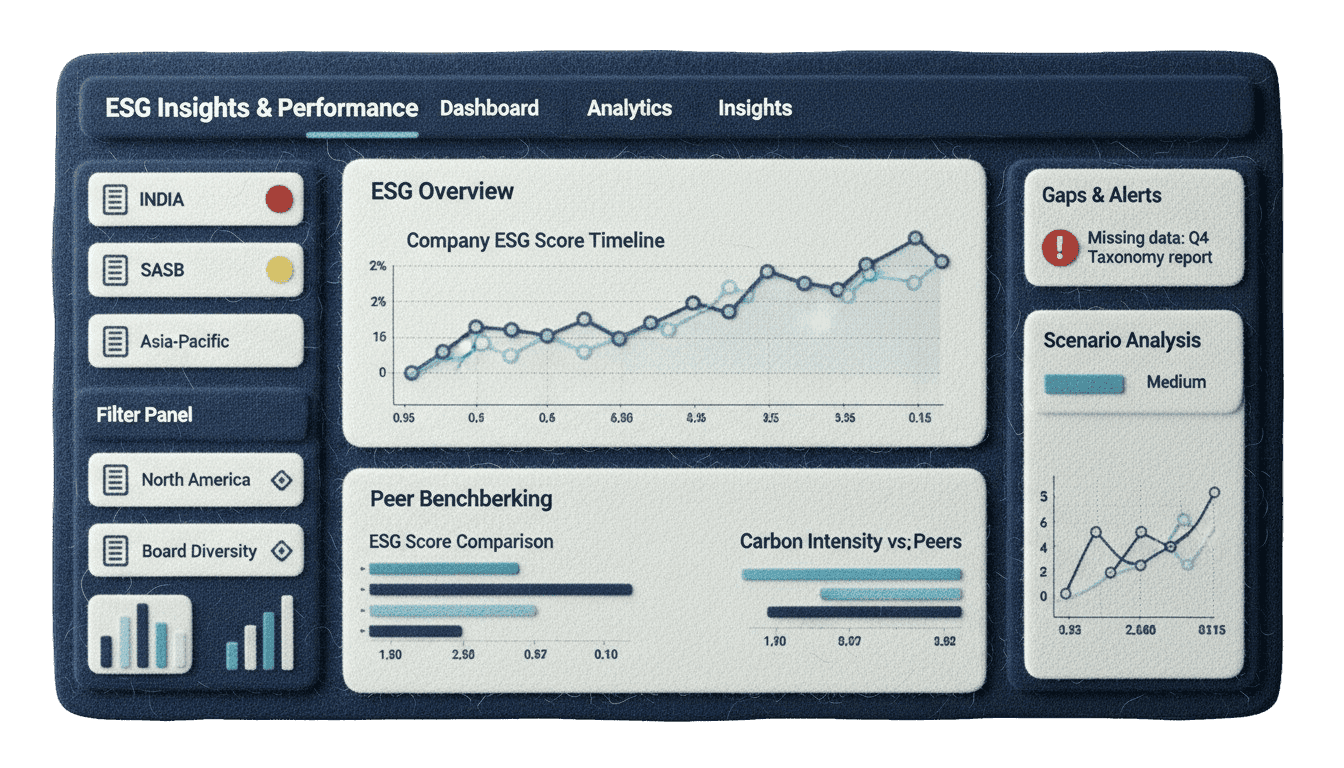

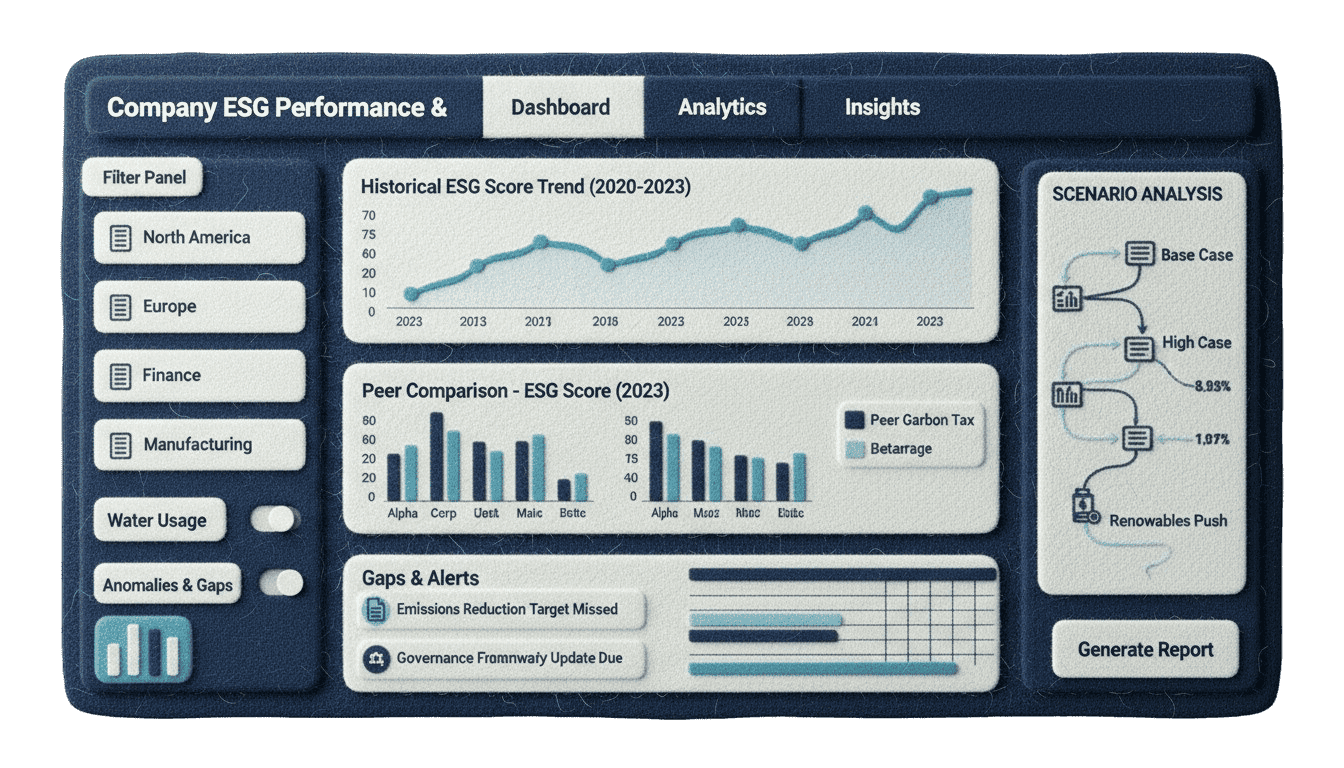

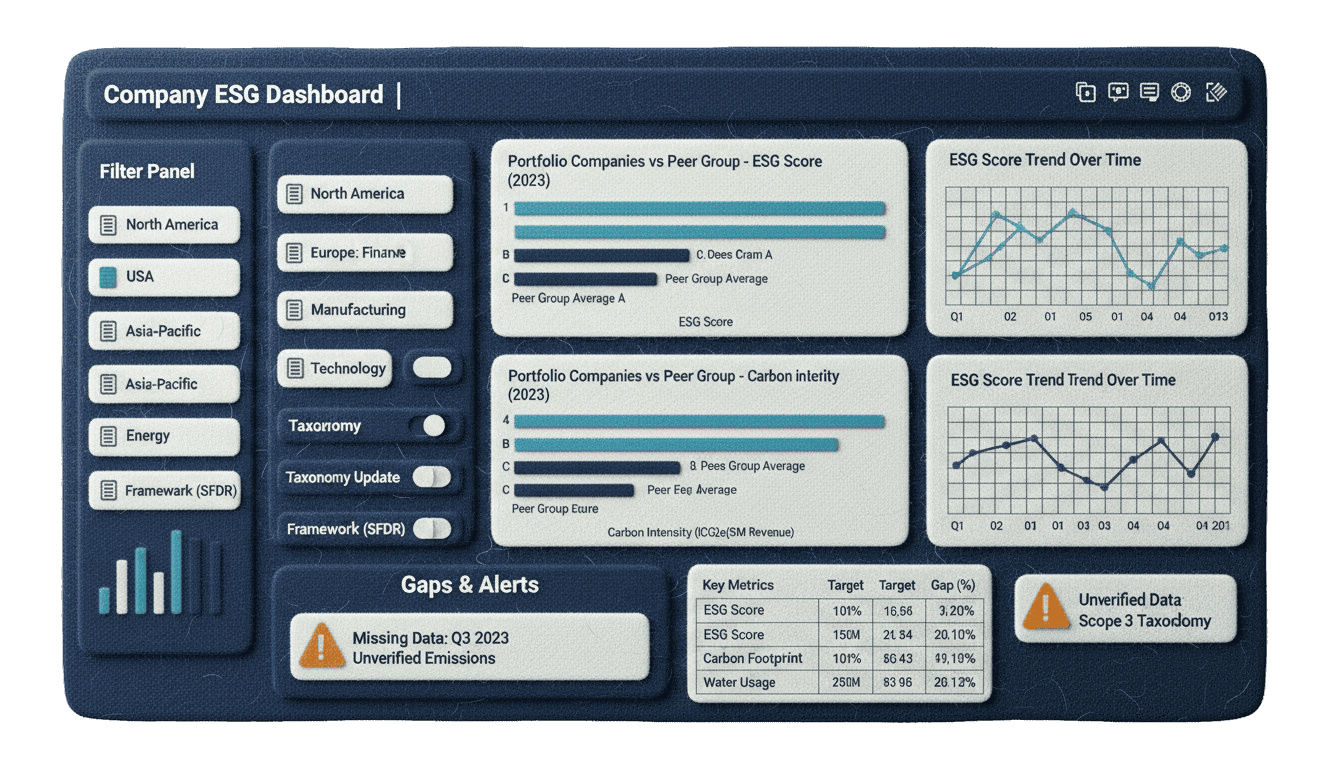

Assess, benchmark, and monitor ESG performance of privately held firms globally.

Company ESG scores & metrics dashboards

Peer benchmarking filters (region, sector, size)

Historical trend charts & scenario analysis

Gaps & alerts (missing data, anomalies)

Use Cases:

PE due diligence: identify ESG red flags before investment

Portfolio monitoring: track progress and signal deterioration

Impact strategy: find improvement opportunities with ROI

Track ESG-related innovation—identify technology trends, white spaces & competitor R&D.

Global ESG patent search by keyword / class / inventor

Timeline and geographic distribution charts

Innovation heatmaps (regions, sectors)

Top assignees, patent clusters, filing trends

Use Cases:

Corporate R&D & IP scouting

Investor insight into disruptive tech trends

Thematic portfolio construction (e.g. climate tech, circular economy)

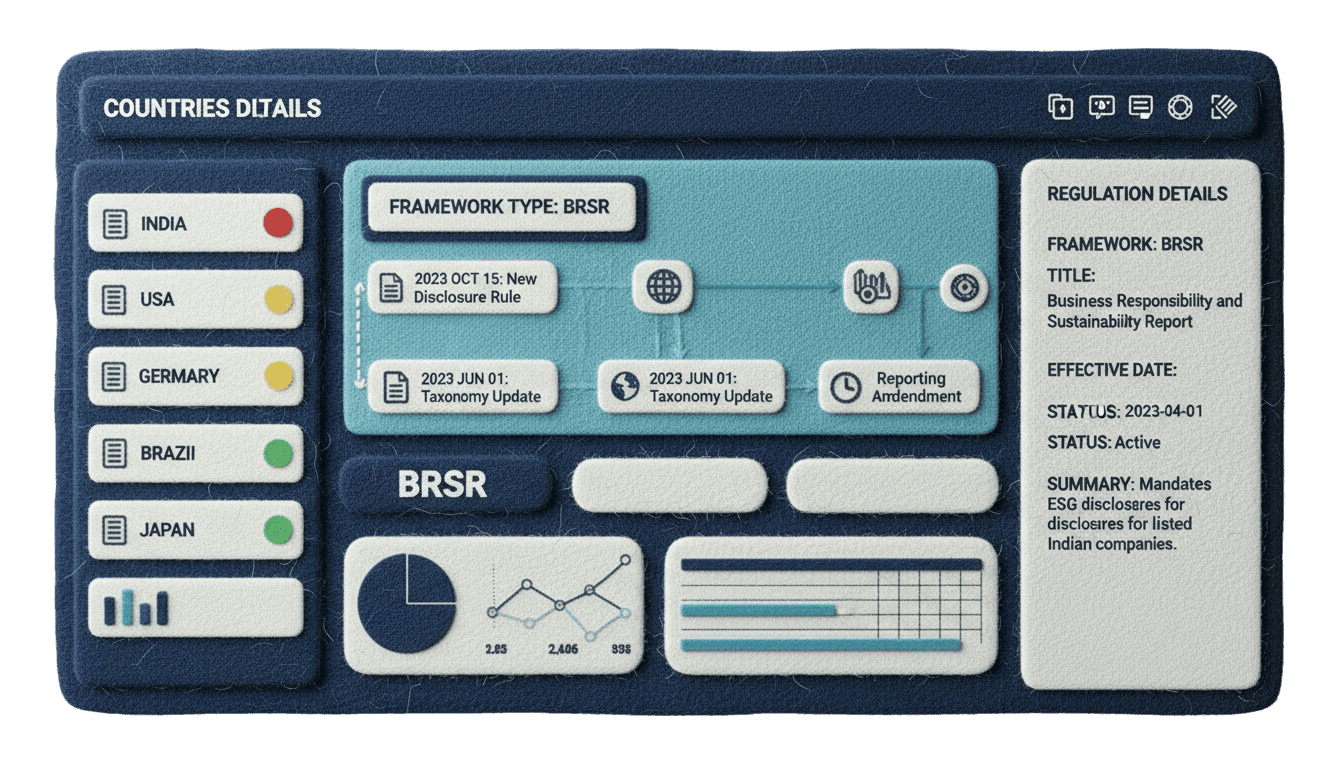

Keep ahead of evolving ESG regulation, compliance deadlines, taxonomy shifts.

Jurisdictional regulation summaries (country-level)

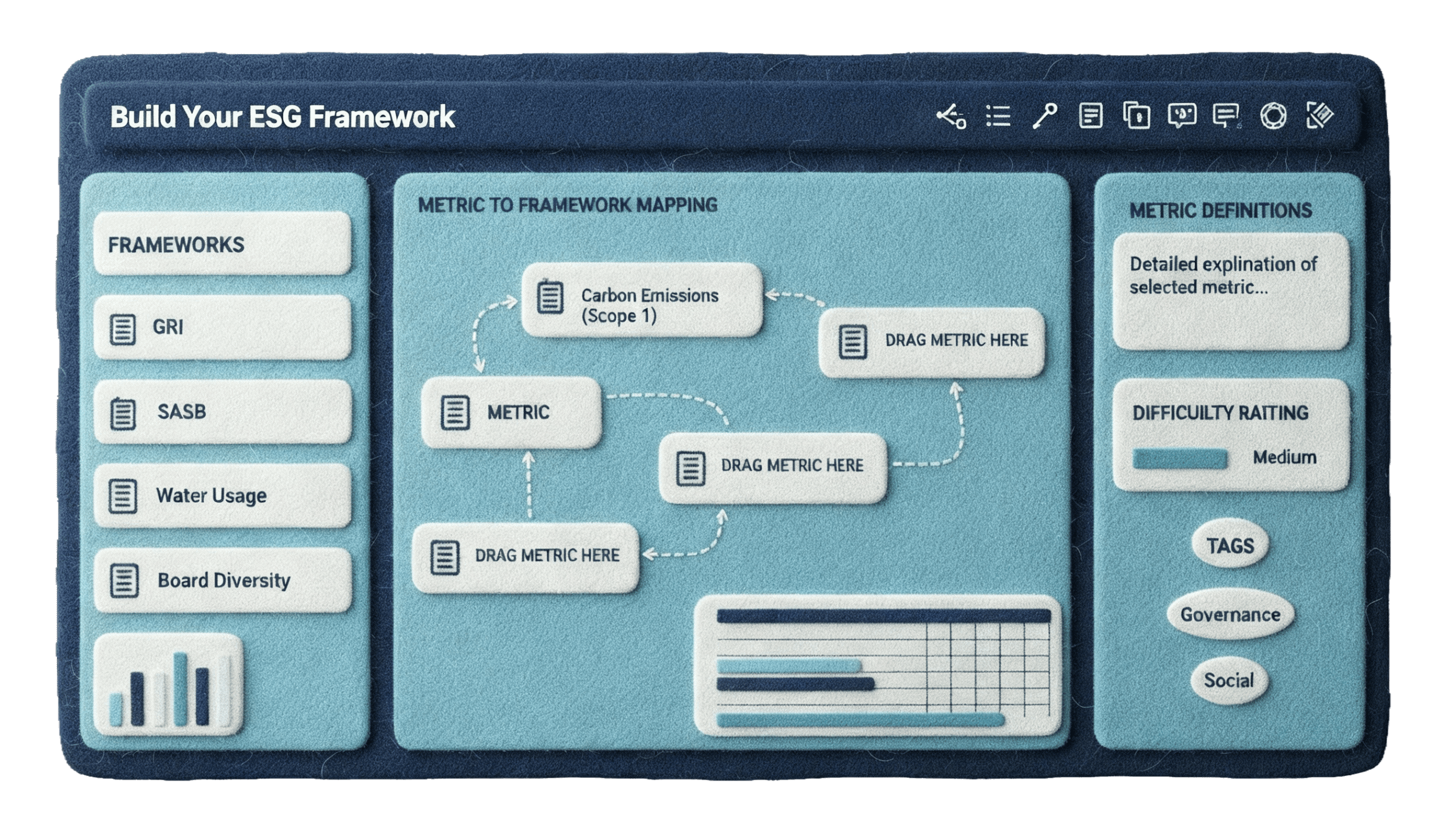

Framework alignment and mapping (BRSR, CSRD, etc.)

Change timeline, upcoming rules & effective dates

Alerts & commentary summaries

Use Cases:

Compliance teams: monitor regulatory risk across multiple regions

Product teams: map requirements to data/features

Strategy teams: anticipate regulatory direction and plan expansion

Real-time insight into ESG events and controversies impacting portfolios.

AI-curated news feed & alerts

Sentiment analysis and risk scoring

Categorization (environment, social, governance) on curated taxonomy

Use Cases:

Proactive risk management (reputational, litigation, supply chain)

Event-driven investment / exit signals

LP/GP reporting dashboards: tracking news & key events

Map ESG labor dynamics—where talent is moving, which firms are hiring, and skills demand.

Heat map of hiring intensity by region

Time series of job postings by role (e.g. Head ESG, Sustainability Analyst)

Sector / skill breakdown (renewables, carbon, governance)

Use Cases:

Talent planning & hiring strategy

Market research for ESG recruitment firms

Talent-driven thematic signals (emerging sectors, geographies)

Get In Touch and See NeoImpact In Action

The NeoImpact platform has transformed our approach to ESG due diligence for Canadian investments. We’re now able to benchmark and report with confidence across all provinces.

– ESG Officer, Canadian Pension Fund

NeoImpact’s comprehensive approach to ESG reporting ensured we stayed compliant with evolving UK regulations while surfacing actionable insights for our portfolio. Their team’s regional expertise made all the difference.

– Director, UK-based Private Equity Firm